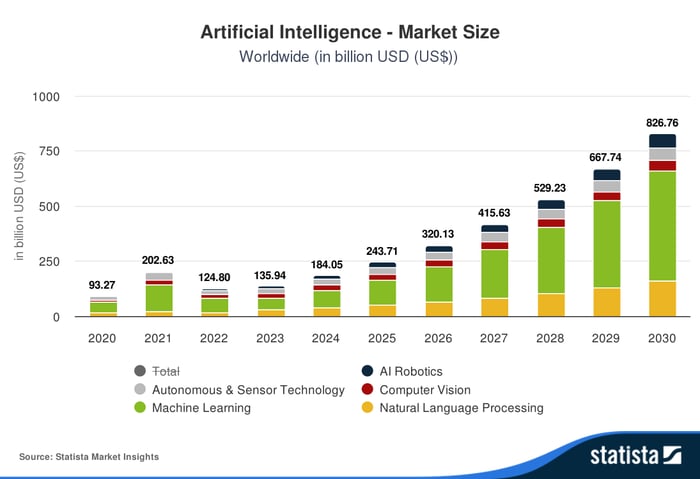

The bull market on Wall Avenue persists, aided by shares like Nvidia and Microsoft, that are posting great outcomes on the again of the substitute intelligence (AI) increase. Realizing when to take a position with the market close to all-time highs is troublesome. Many individuals really feel the bull market will proceed with a perceived business-friendly incoming administration and Large Tech investments in AI. These firms are forecast to pour $250 billion into capital expenditures subsequent 12 months alone. And, as proven beneath, income from AI might exceed $820 billion by 2030.

Chart by Statista.

This doesn’t suggest shares will proceed rising; there are at all times dangers. I am going to talk about shopping for methods in a bull market beneath. However first, listed here are two very completely different firms that would every present wonderful long-term returns.

Dell’s monumental information middle alternative

The variety of hyperscale data centers (these over 100,000 sq. ft) eclipsed 1,000 this 12 months, and the forecast is for at the very least 120 to come back on-line yearly for the foreseeable future. These large facilities, some over 1 million sq. ft, want infrastructure like servers. Dell (DELL 2.58%) is a market chief on this space. Dell’s Infrastructure Options Group recorded file income final quarter, $11.6 billion, with 38% progress. The corporate’s complete gross sales elevated 9% to $25 billion for the quarter.

Dell believes its addressable market in AI might be $124 billion and its complete infrastructure market $265 billion by 2027. Current developments at its competitor Tremendous Micro Pc probably imply Dell will seize much more of this market than beforehand anticipated. Supermicro is reeling from a brief report, delayed monetary filings, and the resignation of its auditors. Its public struggles ought to profit its competitors. As proof, analysts have been busy elevating their Dell worth targets this month.

Wells Fargo raised its goal from $140 to $160 per share, whereas Morgan Stanley raised its goal from $136 to $154. The targets are 7% to 11% above the present worth; nevertheless, if Dell continues to dominate the server market, analysts will probably elevate them once more. Shareholders additionally profit from a dividend and share buyback program that returned a mixed $1 billion final quarter. Dell expects to extend its dividend by 10% yearly by means of at the very least fiscal 2028. The AI alternative, competitor struggles, and rising worth targets make Dell a tempting inventory to personal for the subsequent a number of years.

Amazon’s gigantic information processing alternative

Shifting from an organization that provides information facilities to at least one that builds them results in Amazon (AMZN 1.04%). For example, building has begun on Amazon’s $11 billion information middle in Indiana. These facilities are key to rising the processing and storage capability of Amazon Net Providers (AWS).

Some folks nonetheless consider Amazon as a product firm, however AWS is the straw that stirs Amazon’s drink. The phase accounted for 60% of Amazon’s $60.5 billion working earnings during the last 12 months. It posted a particularly spectacular working margin of 38% final quarter in comparison with 5% for the opposite two segments mixed.

As proven beneath, Amazon’s operating cash flow exploded with plenty of assist from AWS.

AMZN Cash from Operations (TTM) information by YCharts

Amazon inventory trades beneath its five-year averages primarily based on gross sales, working money circulation per share, and earnings, a rarity in right this moment’s record-setting market.

So, what’s one of the best ways to put money into a raging bull market? Investing on the high of a market is dangerous, but it surely’s necessary to not attempt to time the market. Simply because the main indexes are close to all-time highs doesn’t suggest they can not go greater. Listed below are two methods to mitigate danger.

First, take into account dollar-cost averaging — accumulating shares over a number of months. This lets you benefit from declines within the inventory worth and limits the chance of shopping for at a market high. Or, take into account a “buy-the-dip” technique. The market incessantly experiences corrections (declines larger than 10%); nevertheless, we have not skilled one in 2024, though there was one in 2023, 4 in 2022, and 5 in 2020. Nevertheless you select to take a position, take into account Dell and Amazon for a chunk of the AI market.

Wells Fargo is an promoting associate of Motley Idiot Cash. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Amazon and Dell Applied sciences. The Motley Idiot has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.