Bitcoin has shown itself to be the best-performing asset class over the past decade, with an average annualized return of 60% since 2014. This surpasses the returns of gold, the S&P 500, and the Nasdaq 100. Despite this impressive performance, critics often focus on the regular corrections that occur in the cryptocurrency sector.

However, these corrections have actually proven to be excellent buying opportunities over the years. This trend seems to be continuing, as the price of Bitcoin is up 60% year-to-date in 2023 after a significant correction in 2022. This presents an opportune time for investors to consider buying crypto mining stocks at discounted prices.

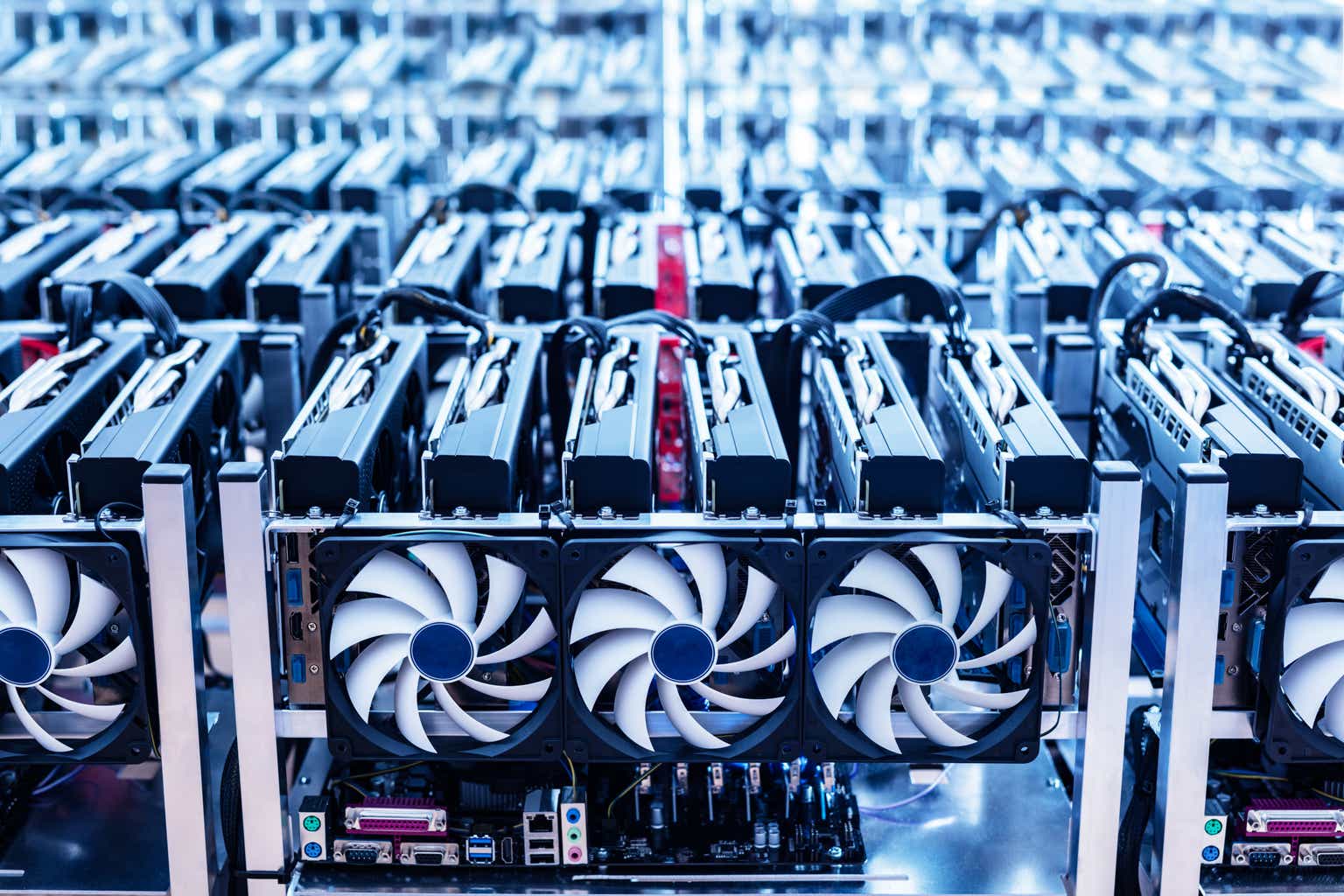

Bitcoin mining stocks offer leveraged gains during bull cycles, but also leveraged losses during bear cycles. As we appear to be in the early stages of a major bull market cycle for the cryptocurrency sector, investing in crypto mining stocks could be a strategic move.

There are several significant catalysts on the horizon for Bitcoin, with one of the most important being the April 2024 halving. During this event, the supply output will be cut in half, reducing the inflation rate for Bitcoin from 3.6% to 1.8%. Historically, the price has rallied leading up to the halving and then experienced a sharp increase afterward.

Another crucial catalyst is the likely approval of the first spot Bitcoin ETF in the United States. Several major asset managers, including BlackRock, Fidelity, and Invesco Galaxy, have applied to list a spot Bitcoin ETF. If just 1% of the wealth these managers control is allocated to Bitcoin, it could represent $180 billion in new capital inflows.

This estimated influx of capital does not even account for the potential multiplier effect from other institutions also being given the green light to invest. Additionally, a spot Bitcoin ETF would create real demand for scarce Bitcoin in the marketplace, which could propel the price even higher.

Furthermore, the recent approval of changes to fair-value accounting by the Financial Accounting Standards Board is good news for crypto miners. These changes allow crypto assets to be classified as financial assets, and gains and losses can be recorded immediately.

Despite the significant pullback in crypto prices from their 2021 highs, which also impacted crypto miners, there are many positive indicators for the cryptocurrency sector. With the current correction, crypto mining stocks have corrected by around 50% from their 2023 highs, creating an attractive buying opportunity.

If Bitcoin were to climb back to its recent highs, mining stocks could potentially see gains of 60% to 80%. And if Bitcoin were to return to its late-2021 highs, the gains could exceed 600% for top crypto mining stocks.

In a comparative analysis of top Bitcoin mining stocks, CleanSpark, Hive Digital Technologies, and Marathon Digital Holdings emerged as the top three performers. CleanSpark had the lowest price/book ratio and debt/asset ratio, and ranked highly in terms of revenue growth, profitability, and Bitcoin mined per processing power.

As crypto prices are expected to trend higher in the coming months, investing in Bitcoin mining stocks could offer leveraged returns. With the potential for substantial cash flows and positive net incomes for miners heading into 2024, these stocks present an enticing opportunity for investors.