China’s e-CNY digital yuan app can now be downloaded from the Apple app store by foreign visitors to the country. This development allows tourists and other foreigners to upload digital yuan to their central bank digital currency (CBDC) digital wallet using their Mastercard or Visa credit card.

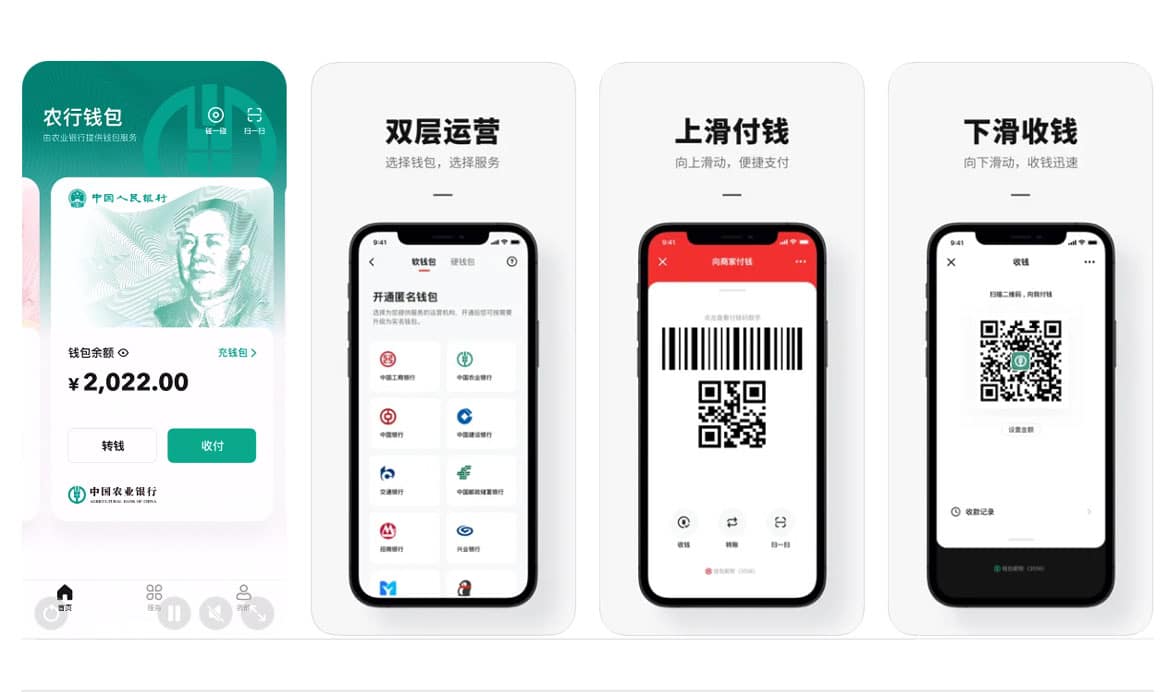

The updated digital yuan wallet can be downloaded for iOS devices from the App Store and for Android devices from the China-based Google Play platform via a virtual private network (VPN). Upon downloading the app, foreign nationals can create a personal wallet and preload it with digital yuan using their international credit card.

With the digital yuan loaded onto their wallets, foreign visitors can use the CBDC to make purchases and other payments at outlets participating in China’s ongoing digital yuan trial program. This marks a significant step forward in the integration of digital currency into everyday transactions and showcases China’s commitment to establishing itself as a pioneer in the CBDC space.

It is worth noting that foreign nationals attending the 2022 Beijing Winter Olympics were among the first to trial making payments with the digital yuan. They could use an app, a contactless wristband, a physical card, or a hard wallet to facilitate transactions, further demonstrating the versatility and convenience of the digital yuan system.

This development highlights China’s efforts to promote the use of digital currency and its potential for widespread adoption. By allowing foreign visitors to participate in the digital yuan ecosystem, China is positioning itself as a global leader in the digital currency revolution. The availability of the e-CNY app on the Apple app store further expands its reach and accessibility.

It is interesting to observe the rapid evolution of digital currencies and their integration into traditional financial systems. As more countries explore the development of CBDCs, China’s progress in implementing and promoting the digital yuan serves as a valuable case study.

As the digital yuan trial program continues and expands, it will be fascinating to see how other countries respond and adapt to the changing landscape of digital currency. The digital yuan’s acceptance and usability by foreign visitors represent a significant milestone that signals the growing acceptance and adoption of CBDCs globally.

In conclusion, the availability of the e-CNY app on the Apple app store for foreign visitors represents a significant leap forward in China’s digital currency journey. By allowing tourists and foreigners to easily access and use the digital yuan, China is paving the way for widespread acceptance and adoption of CBDCs. As the digital yuan continues to evolve, it is likely to have a profound impact on the future of global finance and payment systems.