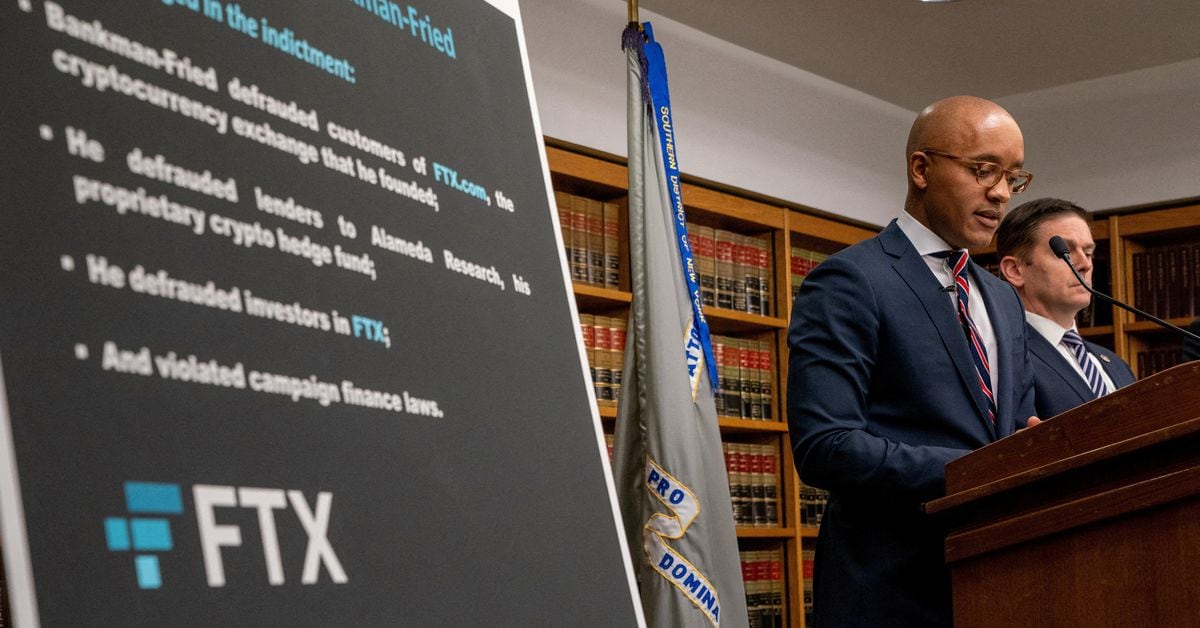

The global cryptocurrency market is still struggling to recover from the collapse of FTX and other major players last year. Crypto prices, volumes, and venture capital investment are all below their 2021 peaks, indicating that the industry is far from the fever pitch it experienced in late 2021.

One of the main indicators of crypto market sentiment is Bitcoin, the largest cryptocurrency. Since November 1, Bitcoin has bounced back about 37%, but it is still a far cry from its record high of $69,000 in November 2021. The collapse of FTX and the bankruptcy of Singapore hedge fund Three Arrows Capital caused Bitcoin to lose more than 65% of its value last year. Additionally, the closure of Silvergate Bank earlier this year further impacted Bitcoin’s price. However, the cryptocurrency has regained almost three-quarters of its value this year, thanks to interest from major financial firms like BlackRock and expectations that interest rate hikes are coming to an end.

The overall value of the crypto market also took a hit after peaking at $3 trillion in November 2021. Following the collapse of FTX, the market value plummeted to a two-year low of $796 billion. It has since recovered to hover around $1 trillion for most of this year. Confidence in the crypto ecosystem has been significantly affected by the issues with FTX, leading to a slowdown in venture capital investments. In the first quarter of 2022, U.S. VC crypto investments totaled $6.12 billion, but that number dropped to just $870 million in the same quarter this year.

Bitcoin’s volatility has also stabilized to some extent this year. While stability might be seen as a positive development, some market participants believe that the attraction of crypto lies in its volatility, which offers opportunities for quick profits.

Since the collapse of FTX, crypto trading volumes have plummeted. Traders who were attracted to the market’s liquidity have paused their activities or even left the market due to the lack of trading opportunities. In September 2023, total monthly volumes across spot and derivative markets fell to $1.4 trillion, down more than 60% from September 2022. Spot markets have experienced the biggest decline, with volumes down more than 70% at $272 billion. Derivative volumes have fallen by 60% to $1.1 trillion in the 12 months since September 2022.

The collapse of FTX and other major players has had a significant impact on the cryptocurrency market. Confidence has been shaken, venture capital investments have slowed, and trading volumes have plunged. While there have been some signs of recovery, the crypto market is still far from its peak in 2021.