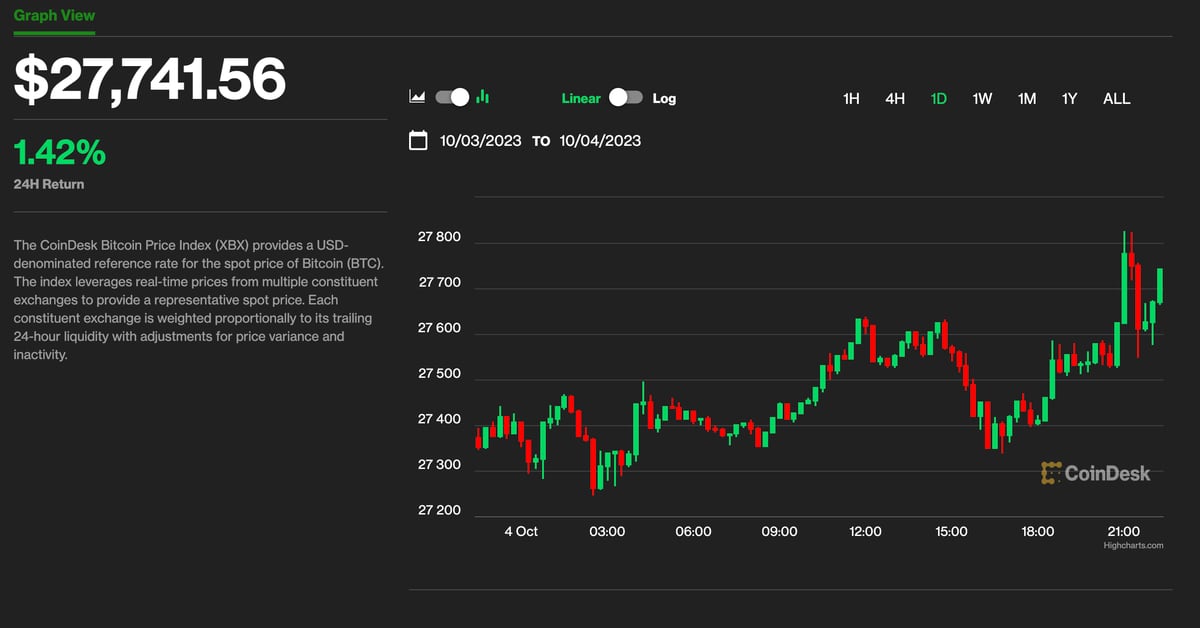

Bitcoin (BTC) saw a modest increase of 1.3% over the past 24 hours as the headwinds in traditional markets eased and the crypto markets calmed down after Monday’s sharp rally. The largest cryptocurrency by market capitalization was trading at around $27,700 during U.S. afternoon hours, briefly surpassing $28,000 earlier in the week before retracting some of its gains.

According to analysts from crypto services provider Matrixport, BTC broke out from its downtrend that started in the summer and turned the $27,000 level into a support level. The analysts suggested that BTC’s price could be heading towards the $30,000 mark. However, the initial surge on Monday did not see a significant follow-through, as BTC’s trading volume dropped from $19 billion to $11 billion.

Enigma Securities, an institutional digital asset liquidity and advisory firm, forecasted that low volatility in the crypto markets will persist for the next few months. Meanwhile, Vetle Lunde, a senior analyst at K33 Research, predicted that markets would likely consolidate and trade sideways in October, providing an opportunity for long-term investors to accumulate positions.

The broader crypto market-proxy CoinDesk Market Index recorded a slight increase of 0.8%.

In traditional markets, the ADP jobs report indicated a cooling U.S. labor market, which helped calm the markets after a turbulent Tuesday. The report showed that the U.S. economy added only 89,000 jobs in September, significantly lower than the expected 153,000 and August’s 180,000 figures. This marked the smallest rise in private sector jobs since 2020.

Despite the bearish ADP report, the S&P 500 index closed the day 0.8% higher, while the tech-heavy NASDAQ 100 index posted a 1.45% gain.

On the other hand, Ether (ETH) underperformed and slid by 0.7% as market participants digested the disappointing first days of the first futures-based exchange-traded funds in the U.S. K33 Research advised investors to rotate into BTC, citing the lack of medium-term catalysts for ETH.

Solana’s native token SOL also saw a decrease of 2.3% in the past 24 hours, retracing some of its gains from earlier in the week. However, the token is still up by over 20% in a week.

Overall, the crypto markets demonstrated resilience and stability as traditional markets experienced some turbulence. While BTC displayed a modest increase, analysts remain cautiously optimistic about its future performance, with predictions of a potential move towards the $30,000 level.