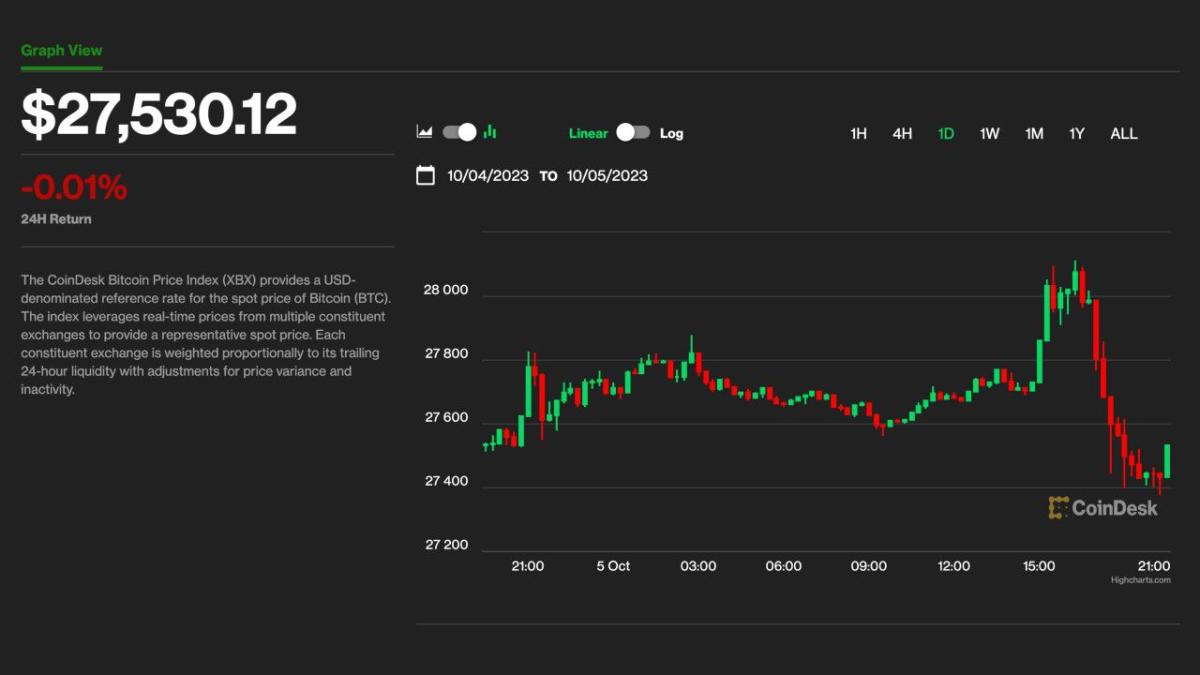

Bitcoin experienced a brief surge above $28,000 before facing a drop to as low as $27,300, signaling a short-lived rally. Despite this decline, the cryptocurrency continues to outperform the broader crypto market. Ether, the second-largest digital asset, also saw a slide of 1.8% over the same period. Some experts expect the market to sell into this rally, believing that the current surge lacks new capital inflow and will therefore be short-lived.

John Glover, Chief Investment Officer of Ledn, anticipates a more sustainable appreciation for bitcoin in the coming year. He suggests that bitcoin has completed its corrective move and expects prices to be higher in three months than they are currently. Glover foresees a sustained rally into the second quarter of 2024.

Investment research firm ByteTree recently upgraded its BTC market signal from neutral to bull, highlighting bitcoin’s resilience amid a tumultuous period for traditional financial markets. Charlie Morris, Chief Investment Officer of ByteTree, believes bitcoin serves as a safe haven from the tumultuous equity and bond trading markets. BTC has been outperforming the U.S. stock market, particularly during a time when surging bond yields have wreaked havoc on traditional markets. Morris predicts that once interest rates attain their peak and the bond sell-off ends, bitcoin will surge.

During bitcoin’s recent corrective move, it managed to hold above the key $25,000 level, which had previously acted as a price cap between May 2022 and March 2023. This retention of support suggests that BTC is still in a bull market, albeit a quiet one.

However, Edward Moya, Senior Market Analyst of the Americas at forex trading firm Oanda, notes that bitcoin remains trapped within a range of $26,000 to $30,000. He believes that the ongoing bond market sell-off is preventing crypto investors from becoming more optimistic, as it poses potential challenges for crypto startups.

As bitcoin continues to navigate market fluctuations, its performance in the coming months will be closely watched. Ongoing developments in traditional financial markets, interest rates, and investor sentiment will likely play crucial roles in shaping bitcoin’s trajectory.