Are you looking to invest in the booming crypto mining industry? Look no further. A profitable crypto mining business for sale might be just what you need to get started.

As the demand for digital currencies continues to rise, the crypto mining industry has become a lucrative market for investors. In this article, we will explore the ins and outs of the crypto mining industry and provide insights on how to find and evaluate a profitable crypto mining business for sale.

The process of crypto mining involves using powerful computers to solve complex mathematical algorithms in order to validate and secure transactions on a blockchain network. This process is essential for creating new coins and maintaining the integrity and security of the cryptocurrency network. With the increasing popularity of digital currencies like Bitcoin and Ethereum, the demand for crypto mining services has skyrocketed, making it a highly lucrative business opportunity.

As the crypto mining industry continues to grow, more and more individuals are looking to buy existing businesses rather than starting from scratch. Buying a crypto mining business comes with its own set of challenges and considerations.

From understanding the technical requirements to evaluating potential risks, there are several factors that buyers need to consider before making a purchase. In the following sections, we will delve into these considerations and provide valuable insights on how to find a profitable crypto mining business for sale.

Understanding the Process of Crypto Mining

Crypto mining, also known as cryptocurrency mining, is the process of verifying and adding transactions to a blockchain ledger. This is done by solving complex mathematical problems using computer hardware. The first miner to successfully solve the problem is rewarded with a certain amount of cryptocurrency. This process is essential for the maintenance and security of cryptocurrencies like Bitcoin and Ethereum.

Understanding the process of crypto mining involves knowing the equipment required, the technical expertise needed, and the energy consumption involved. Here are some key points to consider:

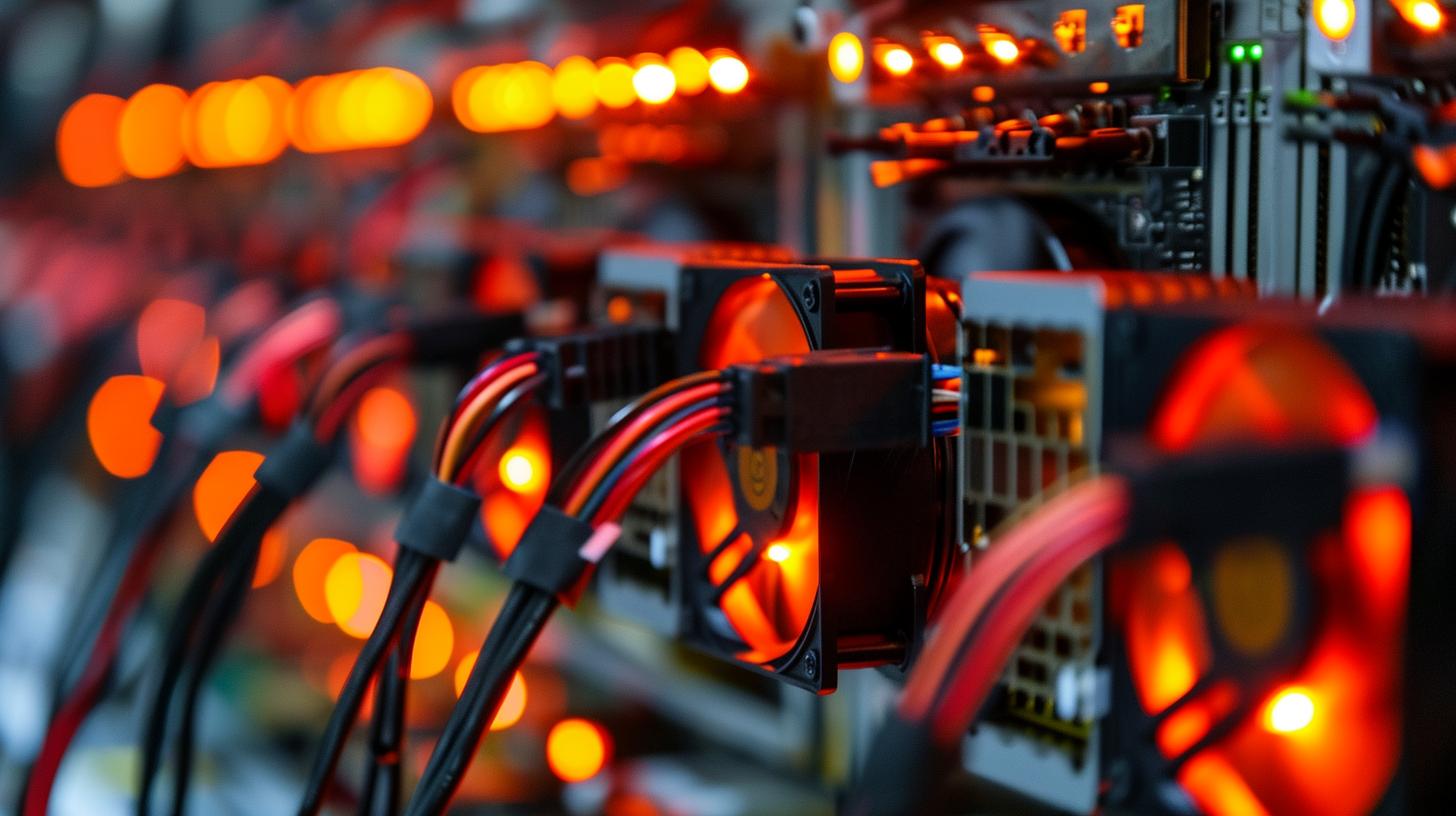

- Equipment: Crypto miners use specialized hardware such as ASIC (application-specific integrated circuit) machines or GPU (graphics processing unit) rigs to mine cryptocurrencies. These machines are designed for high-speed processing and consume significant amounts of electricity.

- Technical expertise: Successful crypto mining requires knowledge of software, algorithms, and network protocols. Miners must be able to troubleshoot technical issues, optimize their equipment for maximum efficiency, and stay up-to-date with the latest developments in the industry.

- Energy consumption: Crypto mining operations consume a large amount of electricity due to the intensive computational work involved. As a result, location plays a crucial role in determining the profitability of a mining business.

Considering these factors is key when entering or investing in a crypto mining business for sale. It’s important to understand that while crypto mining can be lucrative, it also requires significant upfront investment and ongoing operational costs. Therefore, potential buyers should carefully evaluate all aspects of the business before making a purchase decision.

The Growth of the Crypto Mining Business

With the rapid increase in the popularity of cryptocurrencies, the demand for crypto mining has also seen a significant growth. The crypto mining industry has evolved from being a niche interest for tech-savvy individuals to a full-fledged business opportunity for entrepreneurs. As a result, there has been an influx of crypto mining businesses for sale in the market, offering potential buyers the chance to capitalize on this booming industry.

Market Expansion and Demand

The growth of the crypto mining business can be attributed to the expanding market for cryptocurrencies. As more digital currencies gain prominence and attract investment, the need for miners to validate and secure transactions increases. This surge in demand has created an opportunity for existing mining businesses to expand their operations and for new players to enter the market.

Technological Advancements

Advancements in technology have also contributed to the growth of the crypto mining business. More efficient mining equipment and techniques have made it easier for businesses to mine cryptocurrencies at scale, reducing operational costs and increasing profitability. This technological progress has not only attracted more investors to the industry but has also made it more accessible for aspiring miners to start their own operations.

Global Acceptance and Integration

The global acceptance and integration of cryptocurrencies into various sectors have bolstered the growth of the crypto mining business. With an increasing number of retailers, online platforms, and even traditional financial institutions accepting or utilizing digital currencies, there is a growing need for reliable miners to maintain and secure these networks. This widespread adoption has created lucrative opportunities for crypto mining businesses looking to capitalize on this trend.

As the crypto mining business continues to experience substantial growth, it presents an enticing opportunity for individuals looking to invest in this burgeoning industry. However, potential buyers must carefully evaluate several factors before purchasing a crypto mining business for sale in order to maximize their chances of success in this competitive sector.

Factors to Consider Before Buying a Crypto Mining Business

Before investing in a crypto mining business for sale, it is crucial to carefully consider several factors. The cryptocurrency market is known for its volatility, and the success of a mining operation depends on various external factors. Here are some considerations to keep in mind:

1. Regulatory Environment: Before purchasing a crypto mining business, it is essential to understand the regulatory environment in the location where the operation is based. Different countries and regions have varying laws and regulations concerning cryptocurrency and mining activities. Ensure that the business complies with the necessary permits, licenses, and regulations to avoid any legal issues.

2. Market Conditions: The profitability of a crypto mining business heavily depends on the current market conditions. Factors such as the price of cryptocurrencies, network difficulty, and block rewards can significantly impact a mining operation’s revenue. Conduct thorough research on the current state of the market before making any investment decisions.

3. Technology and Equipment: Assessing the quality of the technology and equipment used in the mining operation is crucial. The efficiency of hardware such as ASIC miners and GPU rigs directly affects the profitability of the business. Additionally, staying informed about advancements in mining technology can help determine whether the equipment used is competitive in the industry.

Considering these factors before purchasing a crypto mining business for sale can help potential buyers make informed decisions about their investments. It is important to conduct thorough due diligence and seek professional advice when evaluating opportunities in this dynamic industry.

Benefits of Buying a Crypto Mining Business

As the demand for cryptocurrencies continues to rise, so does the profitability of crypto mining businesses. For those looking to enter this lucrative industry, buying an established crypto mining business can offer a range of benefits. From access to existing infrastructure to a proven track record of success, there are several advantages to purchasing a ready-made crypto mining operation.

Access to Established Infrastructure

One of the main benefits of buying a crypto mining business is gaining access to established infrastructure. This includes everything from high-powered computer systems to specialized cooling equipment and electricity connections. By acquiring an existing setup, you can bypass the time and expense of building your own infrastructure from scratch, allowing you to start mining and generating profits much more quickly.

Proven Track Record

When buying a crypto mining business, you are also acquiring a proven track record of success. This can provide peace of mind and assurance that the business is profitable and capable of delivering returns on your investment. Additionally, having a history of operations can make it easier to secure financing or attract investors if needed in the future.

Reduced Risk and Increased Profit Potential

By purchasing an established crypto mining business, you are taking on less risk than starting from scratch. With existing operations and an established customer base, the potential for generating profits is higher compared to launching a new venture. Additionally, having an operational history allows for better projections and forecasts for future revenue streams.

In summary, buying a crypto mining business offers access to established infrastructure, a proven track record of success, reduced risk, and increased profit potential. These benefits make purchasing a pre-existing operation an attractive option for individuals looking to enter or expand within the crypto mining industry.

How to Find a Profitable Crypto Mining Business for Sale

Cryptocurrency mining has become a booming industry, with the global market size expected to reach $11.8 billion by 2024. As a result, many investors are looking to buy an existing crypto mining business for sale rather than starting from scratch. Finding a profitable crypto mining business for sale can be challenging, but with the right approach and due diligence, it is possible to secure a lucrative investment opportunity.

One of the most effective ways to find a profitable crypto mining business for sale is to network within the industry. Attending industry events, conferences, and meetups can provide valuable insights and connections to potential sellers. Additionally, joining online forums and social media groups dedicated to cryptocurrency mining can also help in uncovering opportunities.

Another important avenue for finding a profitable crypto mining business for sale is through reputable brokers and marketplaces that specialize in buying and selling businesses. These platforms often have listings of established crypto mining operations that are up for sale, along with detailed financial information and performance metrics.

Furthermore, conducting thorough research on the current market trends and regulations related to cryptocurrency mining can help in identifying regions or countries where the industry is thriving. This information can guide potential buyers in pinpointing profitable opportunities for acquiring a crypto mining business for sale.

| Ways to Find Profitable Crypto Mining Business | Benefits |

|---|---|

| Networking within the industry | Access to potential sellers and valuable insights |

| Using reputable brokers and marketplaces | Detailed financial information on available businesses |

| Researching current market trends and regulations | Identifying thriving regions for acquiring businesses |

Potential Risks and Challenges in the Crypto Mining Industry

The crypto mining industry has seen significant growth in recent years, with more and more individuals and businesses getting involved in the process of validating transactions and adding them to the blockchain. However, like any other business, the crypto mining industry is not without its risks and challenges. Understanding these potential pitfalls is crucial for anyone considering buying a crypto mining business for sale.

One of the primary challenges in the crypto mining industry is the high energy consumption associated with running mining operations. The process of solving complex mathematical puzzles to validate transactions requires a significant amount of computational power, which in turn demands a substantial amount of electricity. As a result, operational costs can be quite high, especially in regions where energy prices are not competitive.

Another potential risk in the crypto mining industry is the volatility of cryptocurrencies themselves. The value of cryptocurrencies such as Bitcoin and Ethereum can fluctuate dramatically, impacting the profitability of mining operations. A sudden drop in the value of a cryptocurrency could lead to financial losses for a mining business, especially if they have large holdings of that particular digital asset.

Security concerns also pose a challenge for those involved in the crypto mining business. From hacking attempts to theft, there are various security risks associated with holding and transacting digital currencies. It is essential for any prospective buyer to thoroughly evaluate the security measures in place at a crypto mining business before making a purchase.

| Potential Risks | Challenges |

|---|---|

| High energy consumption | Operational costs |

| Cryptocurrency volatility | Impact on profitability |

| Security concerns | Hacking attempts and theft |

Checklist for Evaluating a Crypto Mining Business for Sale

In conclusion, the crypto mining industry has experienced significant growth and shows no signs of slowing down. As the demand for cryptocurrency continues to rise, so does the potential for profit in the crypto mining business. However, before purchasing a crypto mining business for sale, it is crucial to understand the complexities of the industry and carefully evaluate all factors involved.

When considering buying a crypto mining business, it is important to thoroughly assess the profitability, scalability, and sustainability of the operation. Potential buyers should research market trends, energy costs, hardware requirements, and regulatory considerations to make an informed decision. Additionally, understanding the potential risks and challenges in the crypto mining industry is essential for long-term success.

Finding a profitable crypto mining business for sale requires diligence and strategic planning. It is important to conduct thorough due diligence and seek professional advice when evaluating potential opportunities. By following a comprehensive checklist for evaluating a crypto mining business for sale, potential buyers can mitigate risks and ensure that they are making a sound investment in this rapidly growing industry.