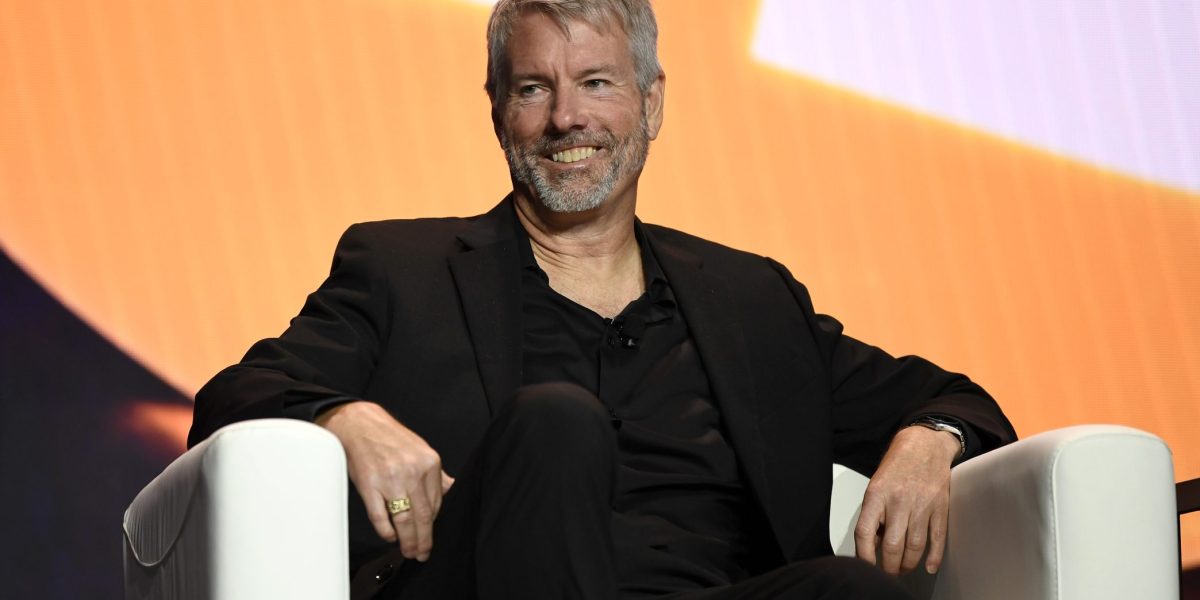

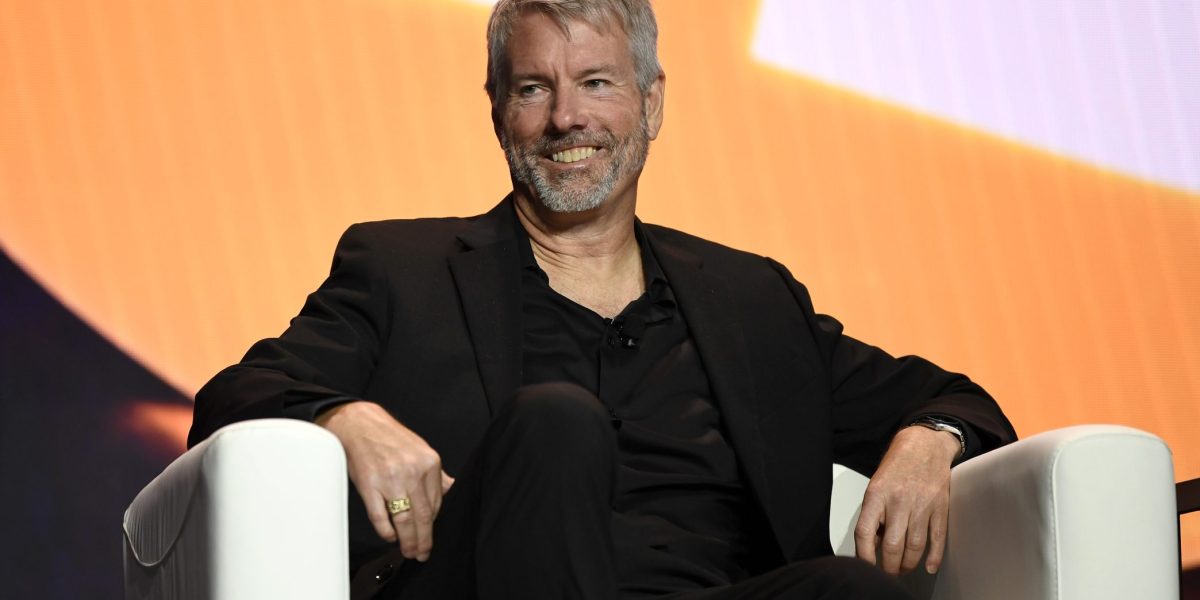

Michael Saylor’s audacious gamble on Bitcoin, once anticipated to spell his doom, has instead turned into a financial bonanza, bolstering both his cryptocurrency assets and his stakes in MicroStrategy, the company he helms as executive chairman. Saylor’s strategic moves in the cryptocurrency market have defied skeptics, translating into substantial financial gains over the past year.

Throughout the year, Saylor has liquidated hundreds of thousands of MicroStrategy shares, amassing $370 million as per a stock-sale agreement established with the company last year. These transactions were meticulously documented in filings with the Securities and Exchange Commission. However, this figure doesn’t fully capture the scale of Saylor’s earnings. His entire portfolio of MicroStrategy shares, coupled with his publicly acknowledged Bitcoin reserves, pegged his net worth at approximately $3.49 billion as of last Friday. This marks a striking 60% or a $1 billion increment since the year’s onset. The resurgence of the crypto sector at the beginning of 2023 further padded his wealth, pushing his paper gains close to $3 billion.

MicroStrategy’s share value has seen a meteoric rise, thanks primarily to Bitcoin’s price rally and the introduction of several exchange-traded funds tracking the cryptocurrency. The company’s stock has appreciated by 86% after a staggering 300% increase in 2023. Despite a minor setback on Friday, where shares dipped by 2.8%, ending the day at roughly $1,174, the trajectory for MicroStrategy has been overwhelmingly positive. Simultaneously, Bitcoin has enjoyed a 46% increase in 2024, with a near 300% surge since 2023 commenced.

Saylor, who transformed from a Bitcoin skeptic to a full-fledged proponent, has aligned MicroStrategy’s fate closely with that of Bitcoin. Embarking on an aggressive purchasing spree, the company has accumulated over 214,000 bitcoins, representing about 1% of the total bitcoins in circulation. Valued at around $13.7 billion with Bitcoin priced at about $64,000 each, these holdings underscore Saylor’s deep financial stake in the cryptocurrency’s performance.

Yet, Saylor’s journey hasn’t been devoid of challenges. Following his early success with MicroStrategy during the dot-com era, he encountered significant turbulence in 2000 when it was revealed that the company’s reported earnings were substantially overestimated. This misstep led to a dramatic loss of $6 billion in a single day for Saylor and subsequent legal troubles with the SEC. Furthermore, his aggressive pivot towards Bitcoin has drawn criticism, with some analysts labeling his strategy as a gross misallocation of investor capital.

Despite the criticism and previous setbacks, Saylor’s conviction in Bitcoin remains unwavering. He envisions the cryptocurrency not just as a digital asset but as a fundamental shift in the concept of value storage, rivaling traditional gold. While the ultimate outcome of MicroStrategy’s Bitcoin-centric strategy remains uncertain, Saylor’s recent financial windfall demonstrates the potential rewards of betting big on digital currencies.

His bullish stance on Bitcoin, characterized by his belief that it will supersede gold as a preferred value store, highlights a visionary approach to investment, seeking not only to leverage current market trends but also to shape the future landscape of digital finance.