Steven Cohen of Point72 Asset Administration simply raised the fund’s place in foundry specialist Taiwan Semiconductor Manufacturing.

Steven Cohen is a billionaire hedge fund investor who serves as CEO of Point72 Asset Administration. Whereas parsing by Point72’s most up-to-date quarterly 13F filing, I got here away with one fairly clear conclusion: Cohen is bullish on synthetic intelligence (AI). Within the September-ended quarter, a few of Point72’s extra outsized purchases had been in “Magnificent Seven” shares together with Nvidia, Alphabet, and Microsoft.

Certainly, I see quite a lot of benefit in proudly owning large tech shares because the AI narrative continues unfolding. However good traders like Cohen know that there are many different alternatives hiding in plain sight. One other latest buy that actually caught out to me was Point72’s funding in Taiwan Semiconductor Manufacturing (TSM -0.47%). In the course of the third quarter, Cohen’s fund scooped up roughly 588,000 shares — growing his stake by 95%.

Under, I will define why I see TSMC (because it’s generally identified) as a once-in-a-decade alternative for AI traders and break down if now is an effective time to observe Cohen’s lead.

What does TSMC really do?

Semiconductor corporations equivalent to Nvidia, Superior Micro Gadgets, and lots of others specialise in designing superior chip ware that powers myriad generative AI purposes and {hardware} gadgets all world wide. What many individuals do not fairly notice, nonetheless, is that these corporations outsource a lot of their manufacturing efforts.

That is the place TSMC enters the image. Its foundry process is used closely by most of the world’s main semiconductor corporations. Do not consider me? Contemplate the truth that it manufactures gear for Nvidia, AMD, Amazon Net Providers (AWS), Broadcom, Intel, Qualcomm, Sony, and lots of extra. The following decade appears extremely vivid for TSMC.

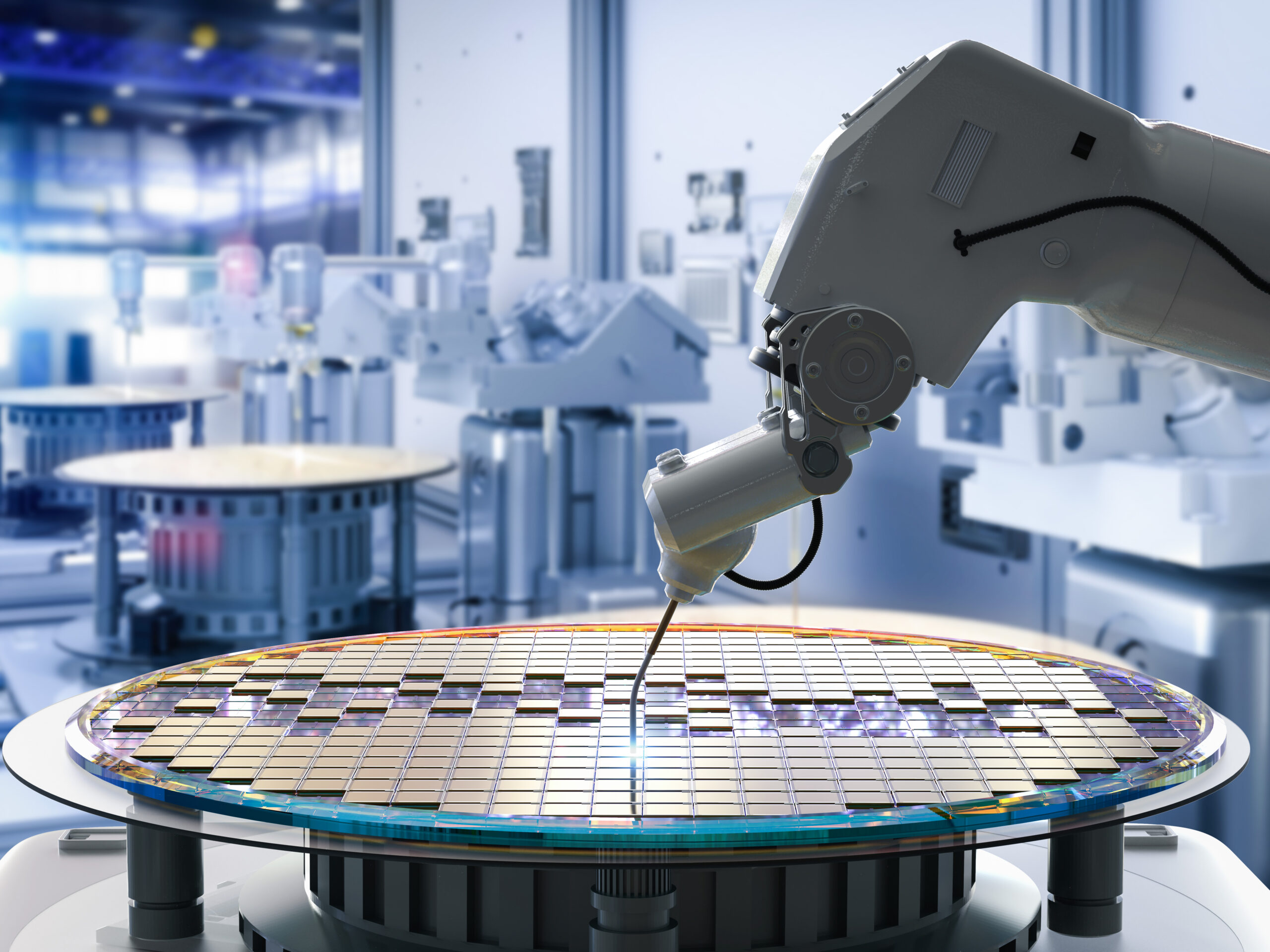

Picture supply: Getty Photos.

Why the subsequent a number of years look bullish for TSMC

It is not sufficient to say that TSMC’s future is vivid as a result of the AI market is gigantic. Such a place is simply too obscure and is rooted in surface-level assumptions. As a substitute, I will break down two explicit market alternatives that TSMC is positioned to dominate over the subsequent decade:

- International semiconductor foundry market: Based on Market.us, the worldwide complete addressable marketplace for semiconductor foundries is forecast to develop at a compound annual fee of 8.5% between 2024 and 2033 — in the end reaching a measurement of $276 billion by early subsequent decade. Proper now, TSMC is estimated to personal 62% of the worldwide foundry market — with the subsequent closest competitor, Samsung, reaching 13% of the market. With such an infinite lead and a number of tailwinds that I will tackle under, I feel TSMC is well-positioned to proceed buying incremental market share as the necessity for foundry companies continues to rise.

- International GPU market: My fellow Idiot.com contributor Keithen Drury lately made an important level in that use circumstances for graphics processing models (GPUs) do not actually matter for a corporation equivalent to TSMC. On the finish of the day, as long as chip designers are innovating and popping out with subsequent era GPUs, there is a actually good probability that TSMC is concerned within the manufacturing course of. As I outlined in a previous piece, the global GPU market size is predicted to eclipse $1.4 trillion by 2034.

Each Nvidia and AMD have new GPU architectures coming to market over the subsequent few years. Furthermore, most of the Magnificent Seven corporations are additionally starting to develop their very own internally made chips in an effort to compete extra carefully with incumbents.

Contemplating TSMC’s present footprint within the foundry market, the truth that it already works with most of the world’s main chip companies, and the tailwinds fueling the GPU market, I stay as bullish as ever on the corporate’s prospects to proceed producing strong progress for the lengthy haul.

Is Taiwan Semiconductor inventory a purchase proper now?

As I write this, TSMC trades at a forward price-to-earnings (P/E) a number of of 21.5. To place this into perspective, TSMC’s ahead P/E round this time final yr was about 16.3. Though there’s been some appreciable valuation expansion during the last yr, I feel the transfer is warranted. TSMC is a drive to be reckoned with within the foundry house, and the corporate’s diversified buyer base alerts far more progress to return over the subsequent a number of years as demand for GPUs continues to skyrocket.

In my eyes, TSMC is a compelling buy-and-hold alternative for traders with a long-term time horizon. I feel now is a good time to observe Cohen’s lead and get in on the motion.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Intel, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure policy.