The developments surrounding Tremendous Micro Laptop (NASDAQ: SMCI) have turn out to be a few of the most fascinating chapters within the broader synthetic intelligence (AI) story.

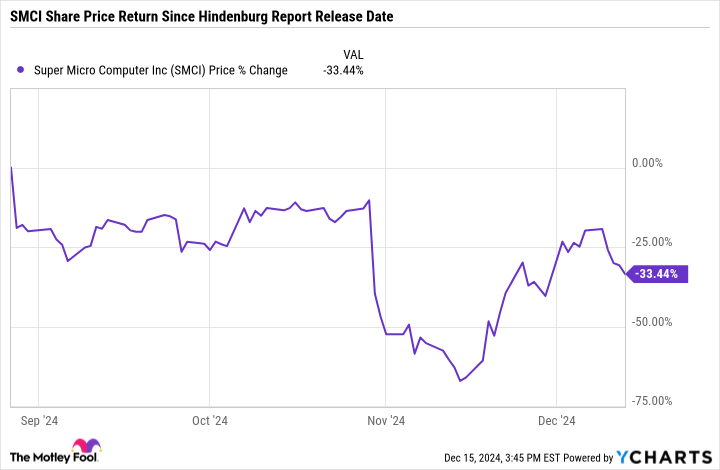

At its peak, shares of Supermicro have been up over 300% earlier this 12 months. Nonetheless, starting in August, shares entered a chronic sell-off of epic proportions.

Over the previous couple of months, it has been a collection of falling dominoes for Supermicro. But, what if I informed you higher days may very well be on the horizon?

I will element every part that is taking place at Supermicro and clarify why the inventory entered freefall. Extra importantly, I am going to additionally discover why Supermicro may very well be on the verge of a turnaround, and what that might imply for traders.

There have been so many ongoing storylines at Supermicro over the previous couple of months that is it is legitimately tough to maintain up with all of the hoopla. Beneath is an annotated timeline of every highway bump Supermicro has encountered, and a few particulars across the inventory motion in consequence.

-

August: In late August, Hindenburg Analysis revealed a report alleging accounting malpractice protocols at Supermicro. Inside one buying and selling day of Hindenburg’s report changing into public data, shares of Supermicro cratered by 19%. This was the primary domino to fall. Precisely in the future after the Hindenburg report was launched, Supermicro filed an 8K asserting that the corporate “expects to file a Notification of Late Submitting” for its 10K annual report.

-

September: A few month after the Hindenburg piece, The Wall Avenue Journal reported that the Division of Justice (DOJ) was investigating Supermicro over its accounting controls, following a collection of allegations touted by whistleblowers. The committees on the Nasdaq inventory alternate additionally despatched Supermicro a discover explaining that the corporate was vulnerable to being delisted from the exchange attributable to compliance causes.

-

October: On Oct. 30, it was revealed that Huge 4 accounting specialist Ernst & Younger LLP (“EY”) resigned as Supermicro’s auditor.

-

November: In mid-November, experiences started swirling that Nvidia was re-routing some of its Blackwell order flow away from Supermicro. So as to add some context right here, Supermicro specializes within the structure for servers and storage clusters that home Nvidia’s graphics processing items (GPUs). Since Blackwell is predicted to be a bellwether for Nvidia, Supermicro was well-positioned to profit from huge tailwinds surrounding these GPUs.

Whereas accounting fraud is a critical allegation, I might warning traders in opposition to hitting the panic button. It is vital to take into account that brief sellers comparable to Hindenburg have a vested curiosity in seeing a inventory value decline. Furthermore, in gentle of all these highway bumps, Supermicro has taken some respectable steps with the intention to tackle the problems head on and proper the ship.