Progress shares generally is a wild experience. The long-term upside often comes with stomach-churning volatility. Monday.com (NASDAQ: MNDY) is presently experiencing ups and downs. On the time of this writing, shares have fallen roughly 28% from their highs.

The corporate’s software-as-a-service enterprise mannequin is disrupting how workers collaborate within the office, and extra catalysts like product enlargement and artificial intelligence (AI) might produce long-term progress able to delivering outsized returns. The corporate is executing at a excessive stage, making this latest drop a shopping for alternative.

Here’s what you must know.

Monday.com’s main enterprise is its cloud-based collaboration software program. It is a low-code, extremely customizable platform the place individuals can set up duties, share data, and combine automation and apps to enhance office effectivity. Right now, over 225,000 prospects use the product in 200 nations.

The corporate’s progress mannequin is good. It is free for the primary two individuals in a corporation, making it straightforward for any firm to strive. In the event that they prefer it, the software program spreads by way of the corporate, climbing the pricing ladder as extra individuals use it. This gross sales course of has produced a stable 111% internet income retention fee, underlining how prospects spend extra over time.

Monday.com’s long-term upside will depend on the way it builds on its core challenge and activity administration software program to penetrate adjoining markets. Since 2022, the corporate has launched a number of new merchandise, together with a buyer relationship supervisor (CRM) for gross sales, Dev for product and improvement groups, and Service for IT and help. Monday.com has built-in varied AI instruments and options to reinforce its merchandise, main to raised person experiences and stickier prospects.

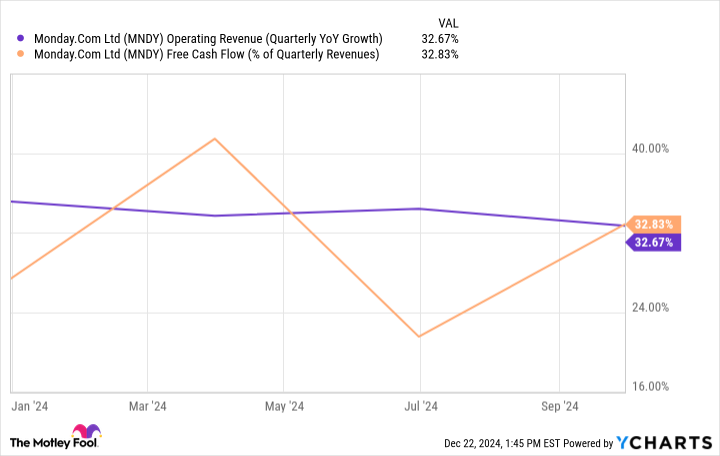

Right now, Monday.com generates $906 million in annual income and grew over 32% 12 months over 12 months in Q3. How excessive Monday.com’s ceiling is stays to be seen, however its product roadmap indicators its intention to grow to be a do-it-all enterprise software program firm. A few of the world’s largest expertise firms, like Adobe and Salesforce, deal in enterprise software program.

If Monday.com persistently converts firms to paid customers and strikes them up the pricing ladder, it’s going to have a protracted progress runway.

Competitors is fierce in enterprise software program, with so many gamers that it may be laborious to search out the most effective of the bunch. Traders can use the Rule of 40 to determine which firms are acting at a excessive stage. The Rule of 40 is a simple metric that measures an organization’s skill to develop with out sacrificing profitability. Add an organization’s income progress fee to its free money circulation margin to calculate its Rule of 40 rating.