Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary information and sample recognition to showcase 5 shares which can be just below the surface and deserve attention.

Traders are continuously on the hunt for undervalued, under-followed and rising shares. With numerous strategies accessible to retail merchants, the problem typically lies in sifting via the abundance of knowledge to uncover new alternatives and perceive why sure shares ought to be of curiosity.

Learn Additionally: EXCLUSIVE: Top 20 Most-Searched Tickers On Benzinga Pro In October 2024 — Where Do Tesla, Nvidia, Apple, DJT Stock Rank?

Here is a take a look at the Benzinga Inventory Whisper Index for the week ending Dec. 20:

D-Wave Quantum QBTS: The corporate was one among a number of quantum computing shares that continued to see sturdy curiosity from readers during the week. The shares traded higher on the week after information from Google that its Willow quantum chip made a breakthrough in quantum computing. The breakthrough of Willow has buyers searching for quantum computing firms that might profit as extra eyes are on the sector heading into 2025. Analysts are taking notice as nicely with Craig Hallum sustaining a Purchase score and elevating the value goal from $2.50 to $9, Benchmark sustaining a Purchase score and elevating the value goal from $3 to $8 and Roth MKM sustaining a Purchase score and elevating the value goal from $3 to $7.

The inventory was up considerably during the last 5 days, as proven on the Benzinga Pro chart below. The inventory is up over 800% year-to-date in 2024.

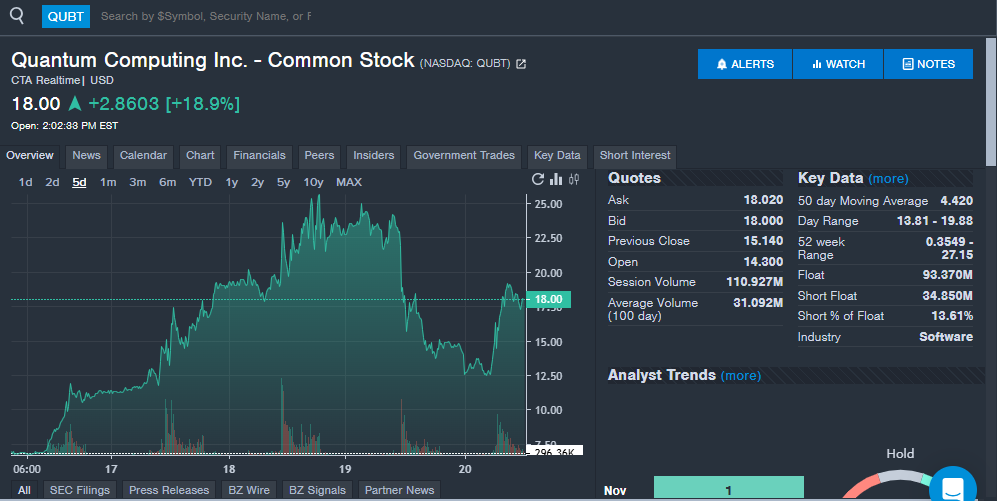

Quantum Computing QUBT: Much like D-Wave, Quantum Computing is likely one of the handful of shares seeing more and more extra consideration from readers due to hovering curiosity within the quantum computing house. The corporate just lately announced a prime contract from NASA for imaging and information processing assist that can use the corporate’s Dirac-3 entropy quantum optimization machine. Quantum Computing stated the contract might result in extra offers if profitable. The corporate has additionally introduced a share providing to strengthen its monetary place.

The inventory was up considerably over the previous week. Shares are up over 1,800% year-to-date in 2024.

SoundHound AI SOUN: The voice AI firm returns to the Inventory Whisper Index for a second time in December. The corporate recently highlighted its awards and recognition it has acquired within the conversational AI market. A partnership with Church’s Texas Rooster for voice AI drive-thru ordering options has additionally put the corporate into the highlight because it continues to assist eating places cut back wait instances, streamline operations and enhance prices with its AI choices. When SoundHound last appeared in the Inventory Whisper Index, the corporate’s AI Good Ordering system was highlighted. The corporate’s AI-powered restaurant options are in use at greater than 10,000 areas around the globe, with the expertise serving to with cellphone, kiosk, drive-thru and headset ordering techniques. The corporate additionally just lately stated its Amelia conversational AI agent has dealt with over 100,000 buyer calls in 2024, serving to with operational effectivity for purchasers. The inventory has additionally been talked about as a potential short squeeze with 13.6% of the float quick in keeping with Benzinga Pro data.

Hear extra about SoundHound from the corporate’s CEO Mike Zagorsek in an unique interview with Benzinga here.

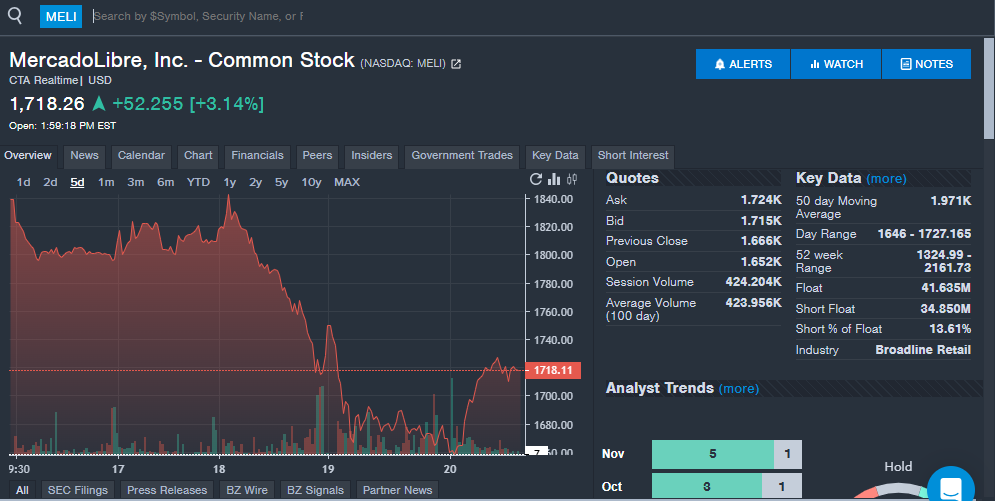

MercadoLibre Inc MELI: The Latin American e-commerce firm noticed sturdy curiosity from readers with none main information from the corporate. The inventory might have fallen on issues of Brazilian shares as a consequence of decrease valuations for its foreign money. The 2024 election and questions on worldwide relations may have despatched shares of Latin American shares decrease in current weeks. MercadoLibre reported third-quarter monetary leads to November with earnings per share lacking analyst estimates and income beating analyst estimates for an eighth straight quarter. A number of analysts maintained bullish scores on the inventory, however lowered value targets after the current monetary outcomes.

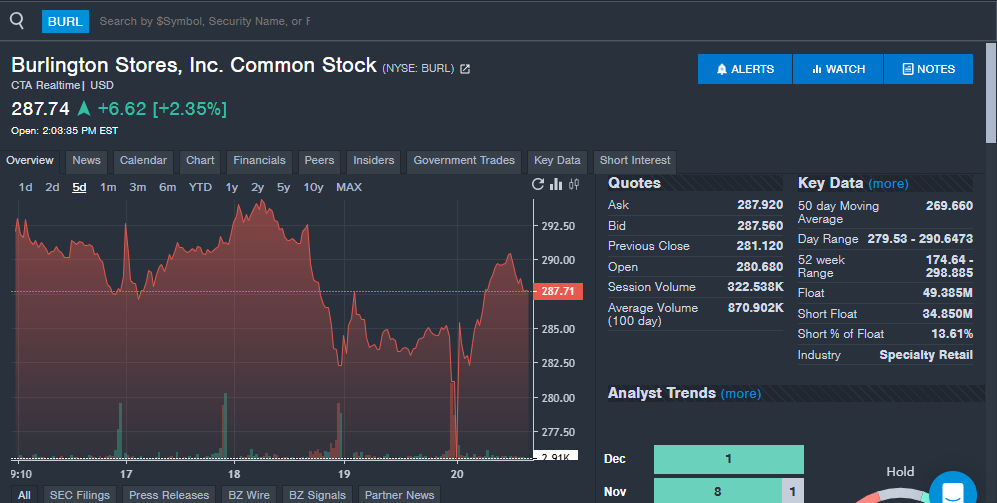

Burlington Shops BURL: The low cost attire retailer noticed elevated curiosity from readers in the course of the week, which comes after third-quarter financial results had been reported in late November. The corporate noticed income up 11% year-over-year within the quarter, however the income determine missed analyst estimates. The corporate cited hotter climate as a cause for comparable gross sales being decrease than anticipated. Administration was optimistic that the fourth quarter would see sturdy development. The vast majority of analysts raised their price targets on the inventory after the quarterly monetary report.

Keep tuned for subsequent week’s report, and observe Benzinga Professional for all the newest headlines and top market-moving stories here.

Learn the newest Inventory Whisper Index stories right here:

Learn Subsequent:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.