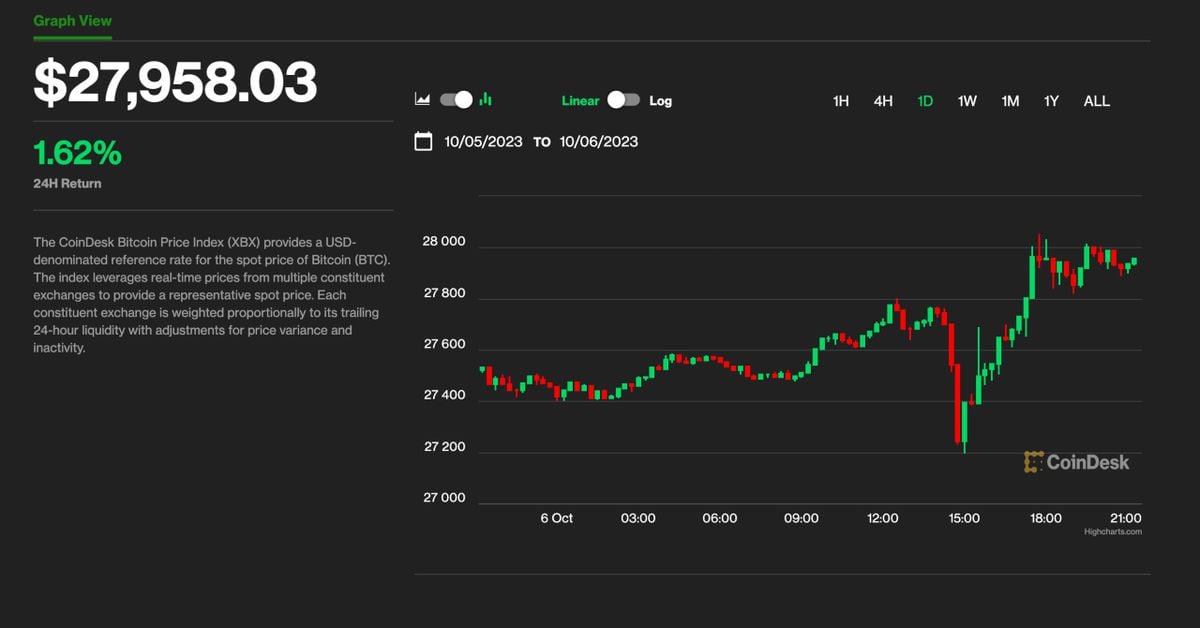

The cryptocurrency market has shown resilience on Friday, with prices on track for gains despite bearish U.S. jobs numbers initially causing a 2% dip. This indicates that investors and traders remain optimistic about the future of cryptocurrencies, even in the face of negative economic data.

The crypto market has been known for its volatility, often reacting to various economic and geopolitical events. Therefore, it is not surprising to see an initial drop in prices following bearish U.S. jobs numbers. However, what is remarkable is the quick recovery and the potential for gains by the end of the day.

Cryptocurrencies have gained significant popularity over the years, becoming a mainstream investment option for many individuals and institutions. Bitcoin, the most well-known cryptocurrency, has been at the forefront of this surge in interest. Despite its relatively short existence, Bitcoin has consistently proven its ability to recover from setbacks and climb to new highs.

The positive outlook for cryptocurrencies can be attributed to several factors. Firstly, the growing acceptance and adoption of cryptocurrencies by major financial institutions and corporations have bolstered confidence in their long-term potential. Companies like Tesla and Square have invested billions of dollars in Bitcoin, signaling their belief in its value as a store of value and hedge against inflation.

Additionally, the ongoing concerns surrounding traditional fiat currencies and their susceptibility to inflation have further fueled interest in cryptocurrencies. With central banks worldwide injecting massive amounts of stimulus and driving interest rates to record lows, investors are increasingly turning to digital assets as a means of preserving their wealth.

Furthermore, the robustness of blockchain technology, which underpins cryptocurrencies, has also contributed to their resilience. The decentralized nature of blockchain ensures security, transparency, and immutability, making cryptocurrencies an attractive option for individuals seeking alternative financial systems.

It is important to note, however, that the crypto market remains highly speculative and volatile. Prices can fluctuate dramatically within short periods, and investors should exercise caution and conduct thorough research before entering the market.

In conclusion, despite bearish U.S. jobs numbers initially leading to a dip, the cryptocurrency market is on track for gains. The resilience and optimism displayed by investors reflect their confidence in the long-term potential of cryptocurrencies. As the market continues to mature and gain wider acceptance, cryptocurrencies have the potential to become an integral part of the global financial system.