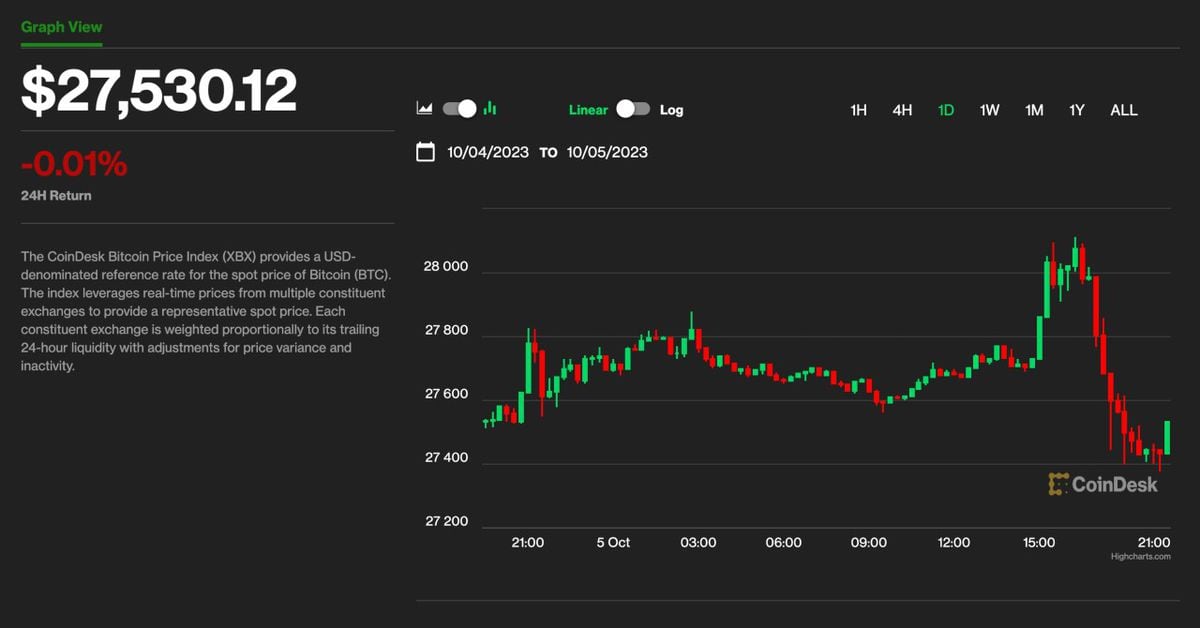

Bitcoin briefly surpassed the $28,000 mark on Thursday morning but subsequently experienced a drop to as low as $27,300 as traders seized the opportunity to sell off their assets. Despite this dip, Bitcoin still outperformed the wider cryptocurrency market, remaining flat at $27,500 over the past 24 hours. In contrast, the CoinDesk Market Index (CMI) saw a 0.3% decrease, while Ethereum (ETH) slid by 1.8%.

According to John Glover, chief investment officer of Ledn, the rally in Bitcoin may be short-lived unless new capital flows into digital assets. He expects a more sustainable appreciation to occur later this year and early next year, as he believes Bitcoin has completed its corrective move and will experience a sustained rally in Q2 2024.

Coinciding with Bitcoin’s positive performance, investment research firm ByteTree upgraded its BTC market signal from neutral to bull in a recent report. ByteTree noted that Bitcoin’s recent price action has defied the downturn in traditional financial markets, serving as a safe haven amid a tumultuous period for equity and bond trading.

Charlie Morris, chief investment officer of ByteTree, highlighted Bitcoin’s superiority over the U.S. stock market, particularly during a time when surging bond yields are wreaking havoc on traditional markets. Morris predicts that once interest rates peak and the bond sell-off subsides, Bitcoin will enter a bullish phase and experience significant growth.

Bitcoin’s ability to remain above the key $25,000 level during its latest corrective move is seen as a bullish signal by Morris. If Bitcoin sustains this level, it is considered to be in a bull market, albeit a quiet one.

Despite the positive indicators, Bitcoin has been described as being “trapped in its $26,000 to $30,000 cage” by Edward Moya, senior market analyst of the Americas at forex trading firm Oanda. Moya suggests that the ongoing bond market sell-off is preventing crypto investors from becoming more optimistic and may negatively impact crypto startups.

In summary, Bitcoin’s brief surge above $28,000 was followed by a sell-off, but it still outperformed the wider cryptocurrency market. Analysts anticipate a sustained rally later this year and early next year, with Bitcoin being regarded as a safe haven amid turmoil in traditional financial markets. However, the ongoing bond market sell-off and stagnant price range are factors that continue to influence market sentiment.