The ether-to-bitcoin (ETH-BTC) price ratio reached a 15-month low this week, surprising many who expected the launch of futures-based ETH exchange-traded funds (ETFs) to spark buying interest. The ETH-BTC trading pair on major crypto exchanges Binance and Coinbase dropped below 0.06, erasing the modest rally it experienced in September.

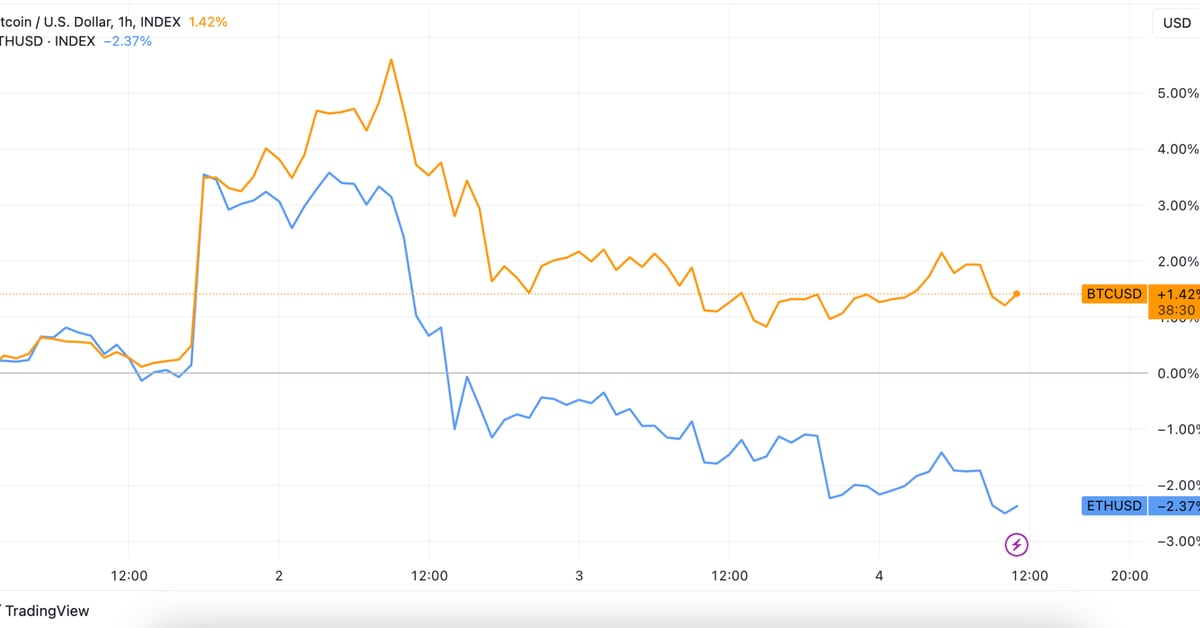

Ether’s price has declined by 2.4% in October, currently sitting at $1,640. It has given up all its gains and more from a brief surge to nearly $1,750 earlier in the month. On the other hand, Bitcoin has gained 1.4% over the same period and has been outperforming ETH on a weekly, monthly, and yearly basis, according to CoinDesk Indices data.

Analysts have started to reassess their investment advice in light of these developments. Vetle Lunde, a senior analyst at K33 Research, suggests it’s time to shift from ETH back to BTC. Lunde notes that the futures-based ETH ETFs’ interest in the U.S. has fallen short of expectations, leading him to abandon his previous advice to increase ETH exposure. He believes Ethereum lacks compelling medium-term narratives and no longer favors overweight ETH exposure.

The lack of any short-term catalysts is resulting in apathy in the cryptocurrency market, and prices may continue to move sideways. Lunde argues that this environment favors Bitcoin, which has medium-term positive catalysts, such as the potential listing of a U.S. spot BTC ETF and its upcoming four-year halving event.

Matrixport analysts also express concerns about Ethereum’s waning activity and its token’s return to being inflationary, potentially further weighing on the ETH price. The firm suggests that Ethereum’s network revenues fell to their lowest since December, indicating that the token may be overvalued by 30%-40% at current prices.

In contrast, BTC could be viewed as a “safe haven” asset during times of market distress, supporting its price amidst growing macroeconomic headwinds. Matrixport states that it’s challenging to identify fundamental catalysts that would support Ethereum or other altcoins, despite their potential upside if the bull market returns.

Enigma Securities, an institutional digital asset liquidity and advisory firm, also highlights ETH’s current precarious position as the ETH-BTC price ratio falls below 0.06. The firm suggests that ETH’s price trajectory may rely on Bitcoin’s performance.

In conclusion, the ETH-BTC price ratio has reached a 15-month low, and analysts are reevaluating their investment strategies. While ETH has struggled, BTC continues to outperform and is seen as a safer bet during uncertain market conditions. As the cryptocurrency market lacks short-term catalysts, investors are advised to monitor Bitcoin’s performance for indications of ETH’s future direction.