Bitcoin Faces Potential Pullback as Government Shutdown Looms

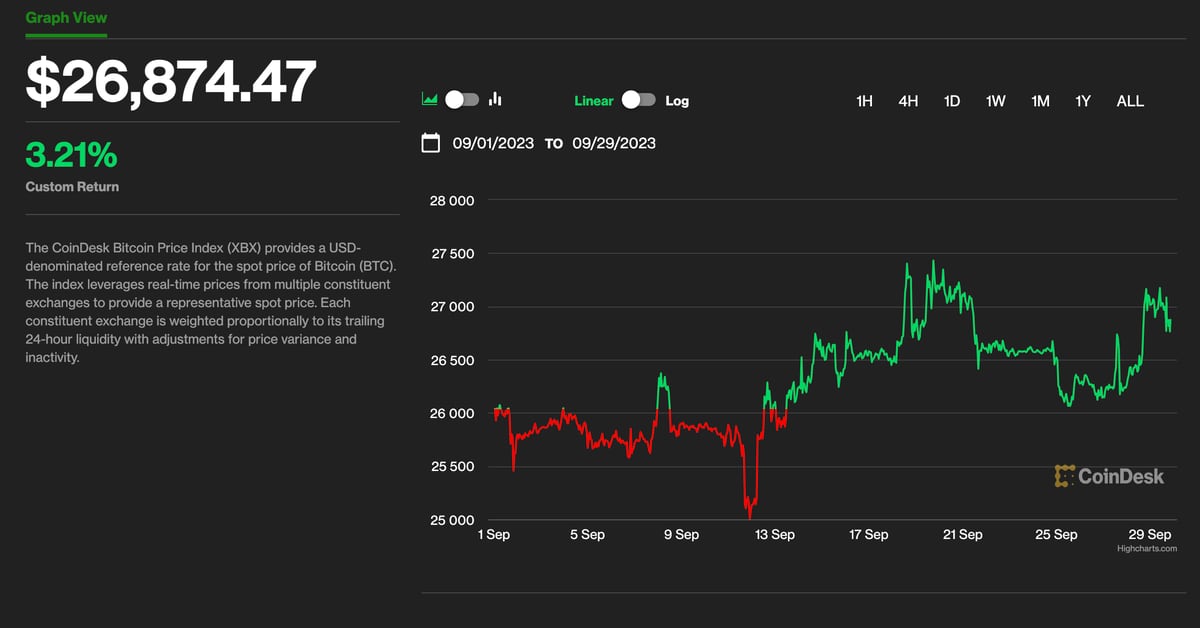

Bitcoin (BTC) has been on a positive trend this month, with a 3.2% return so far. However, a recent pullback has put its provisional monthly gain in jeopardy. This setback comes at a time when there is uncertainty surrounding a possible federal government shutdown. The largest cryptocurrency by market capitalization was trading at $26,800, showing a decline of 1.6% from its recent high of $27,400.

Meanwhile, Ethereum (ETH) has remained relatively flat, trading around $1,660. Market participants are anticipating the launch of futures-based exchange-traded funds (ETF), which could potentially impact Ethereum’s price movement. Other cryptocurrencies like Ripple’s XRP, Solana’s SOL, and Tron’s native token TRON have posted gains ranging from 3% to 5%, outperforming the broader digital asset market.

However, despite the positive momentum in the crypto market, there are concerns about the macroeconomic uncertainty. Bond markets worldwide are showing signs of distress, with yields reaching multi-year records in several major markets. These uncertainties are amplified by the possibility of a U.S. government shutdown, which could further compound the situation.

Noelle Acheson, a macro analyst and author of the Crypto Is Macro Now newsletter, expressed her concerns about the macro uncertainty. She pointed out that the U.S. consumer spending growth in the second quarter was revised lower, suggesting that consumers might not be resilient to tightening financial conditions. The impending U.S. government shutdown adds to the uncertainty, potentially impacting regulatory decisions and delaying the launch of a Bitcoin exchange-traded fund.

Despite these challenges, the crypto market has held up relatively well compared to the stock market sell-off. Digital asset investment firm NYDIG highlighted the potential impact of the government shutdown on regulatory decisions. With reduced staff at the U.S. Securities and Exchange Commission (SEC), the approval of a spot Bitcoin ETF may be delayed.

Looking forward, Asgard Markets, an advisory firm, has a more constructive outlook on risk assets in the fourth quarter. They are optimistic that Bitcoin and Ethereum will break out of their current range and experience a short-term move between $28,500 and $30,000. Historically, October has been a bullish month for Bitcoin, and analysts believe that as interest rates become dovish, Bitcoin could see a significant breakout.

Markus Thielen, Head of Research at Matrixport, also shared his positive outlook for Bitcoin. He highlighted that October has been a profitable month for Bitcoin in the past, with an average return of 22% over the last 10 years. Furthermore, he emphasized that Bitcoin miners, including Marathon Digital, have improved their operations, even though mining costs are increasing due to the halving.

Overall, while Bitcoin’s September gain is currently at risk due to a potential pullback, analysts remain cautiously optimistic about the future of the crypto market, citing positive historical trends and improving mining operations.