Bitcoin Holds Steady Above $26,000 Despite Market Volatility

Bitcoin (BTC) has defied expectations this week, maintaining its position above the $26,000 level despite significant sell-offs in equity markets and the surge of the U.S. dollar. This is seen as a victory for Bitcoin, considering the bearish signals that these other market movements could have indicated.

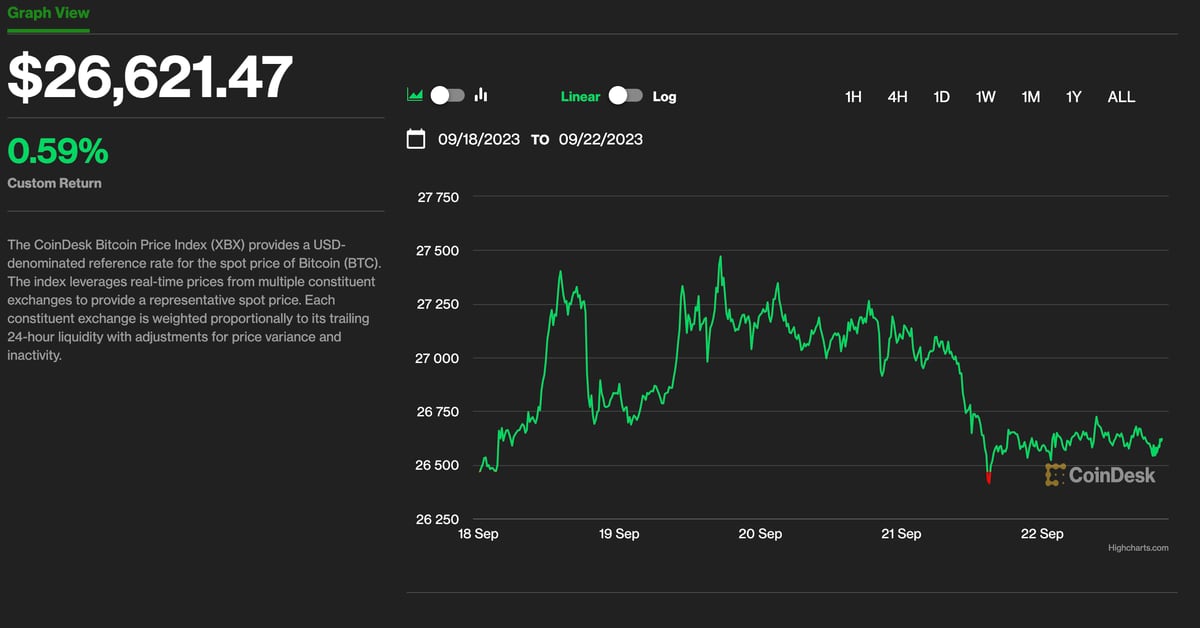

As of Friday afternoon, the largest cryptocurrency by market capitalization was trading around $26,500, registering a slight increase of 0.3% since the beginning of the week. In contrast, the S&P 500 and the tech-heavy Nasdaq Composite Index experienced significant drops of 2.7% and 3.2% respectively.

IntoTheBlock, an analytics firm, described Bitcoin’s steady price action as “remarkable” considering the downturn in the stock market. They noted that one potential reason for this stability is Bitcoin’s correlation with the Dollar Index (DXY), which has reached zero, indicating no relationship between the two.

Additionally, IntoTheBlock revealed that the number of long-term holders, commonly referred to as “HODLers” in the crypto community, is near an all-time high. This could suggest that these investors are holding onto their Bitcoin in anticipation of the potential approval of a spot BTC exchange-traded fund (ETF) in the United States.

These long-term holders have historically played a crucial role in sustaining prices during bear markets and taking profits during bull markets. IntoTheBlock’s report suggests that this trend may signal the beginning of a bullish cycle for Bitcoin. Furthermore, on-chain data indicates that despite the uncertain macro environment, long-term investors continue to accumulate Bitcoin.

BTC briefly reached $27,400 ahead of the Federal Reserve meeting on Wednesday but faced strong selling pressure afterward. Rachel Lin, CEO of derivatives decentralized exchange SynFutures, pointed out that the 200-weekly moving average and 200-daily moving average are both around the $27,800 level and are likely to act as strong resistance in the coming week. She also highlighted the support level between $26,000 and $26,500.

In the options market, the largest open interest is observed for $24,000 puts and $35,000 call options, suggesting that the market expects Bitcoin to stay within that range for the foreseeable future.

Overall, Bitcoin’s ability to hold its ground above $26,000 amidst turbulent market conditions is indeed notable. The growing number of long-term holders and the lack of correlation with the U.S. dollar bode well for the cryptocurrency’s future performance. However, only time will tell how long Bitcoin’s outperformance can be sustained in the face of a worsening macro environment.