Title: Bitcoin Faces Uncertain Future as Higher Interest Rates and Looming Economic Crisis Pose Challenges

Introduction:

Bitcoin, the world’s largest cryptocurrency, has been experiencing a tumultuous journey lately. The Federal Reserve’s recent decision to maintain higher interest rates for longer, along with the possibility of a Wall Street earthquake, has created a nightmare scenario for bitcoin and crypto companies. Additionally, the upcoming historical bitcoin halving event adds to the uncertainty surrounding the crypto market. This article explores the potential ramifications of these developments and their impact on the future of bitcoin.

The Effect of Higher Interest Rates on Crypto Companies:

The Federal Reserve’s decision to hold interest rates at their highest level in over 20 years has raised concerns for crypto firms. Edward Moya, senior market analyst at online brokerage platform Oanda, warns that borrowing costs will remain elevated, making refinancing a challenge for crypto companies. Moya believes that crypto companies not only need rates to peak but also for rate cut expectations to increase. The Fed’s belief in a soft landing may be at risk if inflation reports continue to show sticky inflation, leading to a disappearance of rate cut bets.

Historical Bitcoin Halving Event:

Bitcoin’s historical halving event, which is anticipated to cause price volatility, is fast approaching. This event, scheduled to occur next year, could add further chaos to an already uncertain market. The halving event involves reducing the rewards for bitcoin miners, which could potentially impact bitcoin’s price. Investors and traders are advised to stay informed and prepare for the rollercoaster ride ahead.

The Fallout of Last Year’s Bitcoin Market Crashes:

The crypto market faced a series of collapses last year, culminating in the implosion of major exchange FTX. This led to bitcoin’s price plummeting to lows of $16,000. While the market has since shown signs of recovery, the recent decision by the Federal Reserve to continue tightening its monetary policy raises concerns about the future stability of the crypto market.

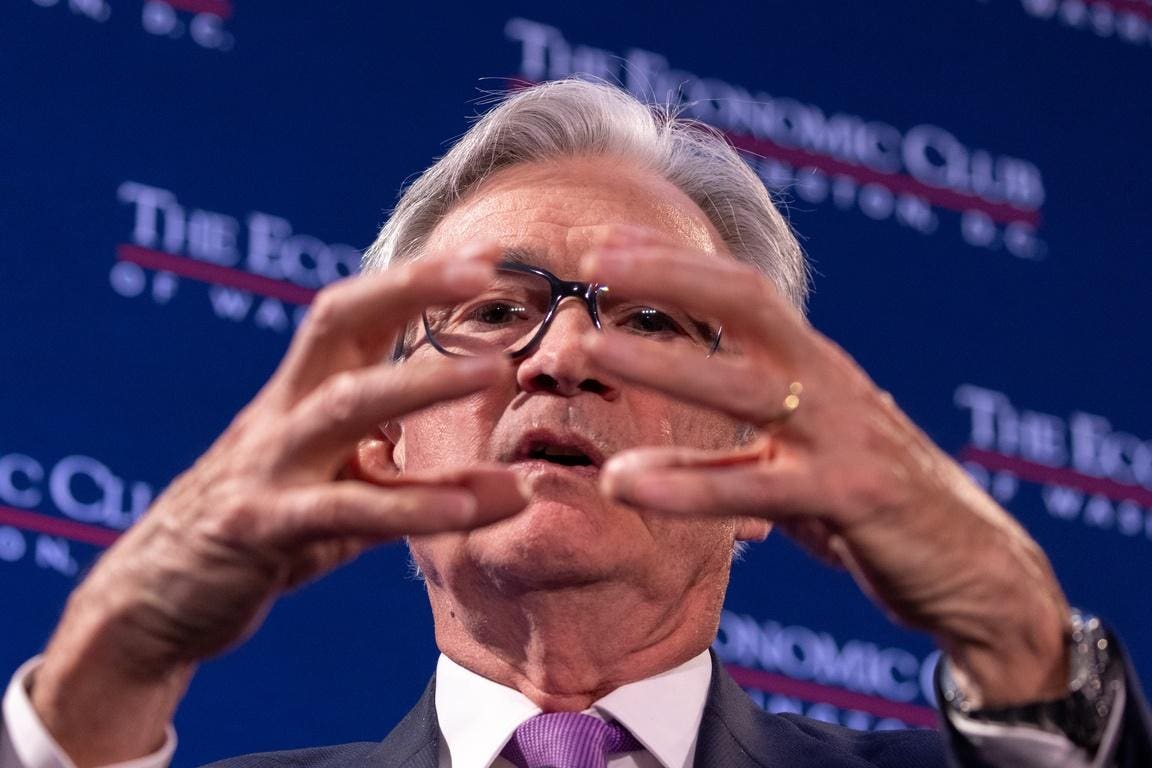

Hawkish Comments from Federal Reserve Officials:

Following the interest rate meeting, two Federal Reserve officials made hawkish comments signaling that the tightening cycle is not yet over. Governor Michelle Bowman stated that further rate hikes would likely be needed to control inflation, while Boston Fed President Susan Collins emphasized that further tightening is still on the table. These comments contribute to the uncertainty surrounding bitcoin and the wider financial markets.

Stock Market Correlation and Bitcoin Price:

Stock markets have experienced sharp declines in recent weeks as investors grapple with the prospect of higher interest rates. The correlation between stock market performance and bitcoin price could result in a similar downward trend for bitcoin. Analysts suggest that the market could witness a volatility squeeze if the looming U.S. government shutdown triggers a financial sector meltdown.

Conclusion:

Bitcoin’s future faces significant challenges due to the Federal Reserve’s decision to maintain higher interest rates, the forthcoming historical halving event, and the potential economic crisis caused by a U.S. government shutdown. Crypto companies will likely face difficulties with refinancing and borrowing costs under the prevailing conditions. Investors and traders must keep a close eye on market developments and remain proactive in navigating the volatile crypto market ahead.