The Ethereum network has been grappling with scalability issues for quite some time. As the popularity and usage of the blockchain continue to surge, it has become increasingly challenging to handle the growing number of transactions. However, recent developments in the form of layer 2 solutions have emerged to address this problem.

Layer 2 solutions are essentially protocols built on top of existing blockchains that aim to improve scalability and reduce fees. These solutions enable faster and cheaper transactions by processing them off-chain and then settling the final outcome on the main Ethereum network, thereby alleviating the burden on the base layer.

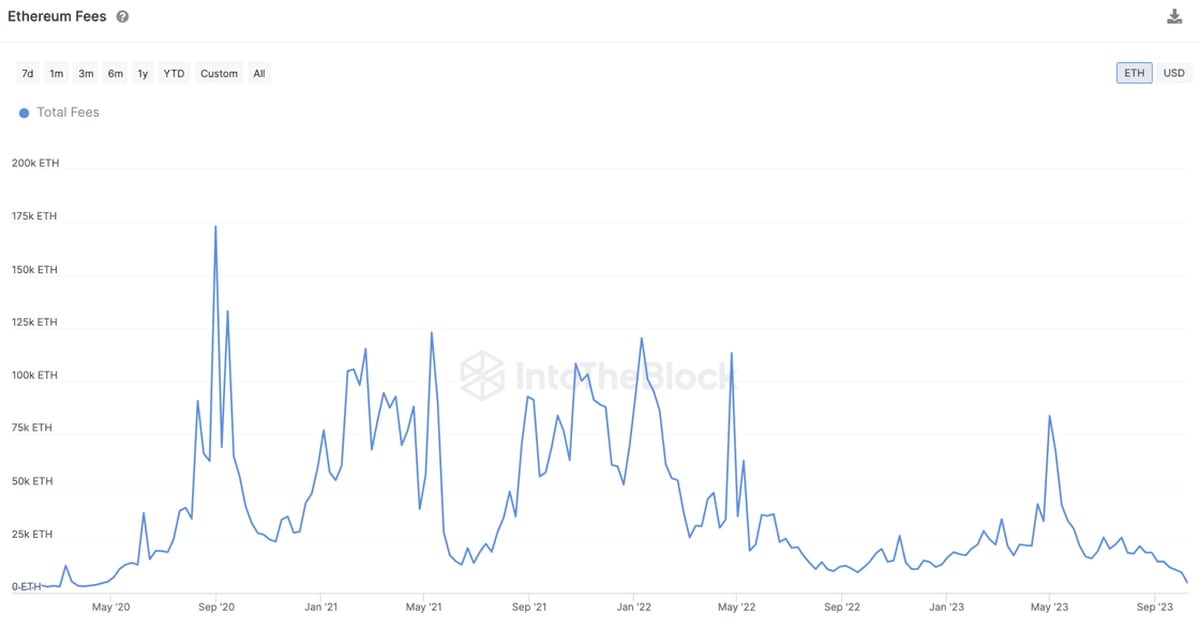

According to a recent report, the proliferation of layer 2s has not only helped Ethereum scale and increase its capacity but has also contributed to the reduction of transaction fees. This is undoubtedly positive news for Ethereum users who have been increasingly frustrated by soaring gas fees and slow transaction processing times.

The introduction of layer 2 solutions has significantly brought down transaction fees, making it more affordable for users to execute transactions on the Ethereum network. This means that users can now send and receive tokens or interact with decentralized applications (dApps) without having to face exorbitant fees.

However, it is worth noting that while layer 2s offer benefits in terms of reduced fees, they also have an impact on the supply of Ethereum’s native token, Ether (ETH). The report explains that these solutions contribute to keeping ETH supply inflationary as fewer tokens are burned compared to the number of new tokens issued.

In the Ethereum ecosystem, transactions typically involve the payment of gas fees in ETH. These fees are typically burned, meaning they are permanently removed from circulation, thereby reducing the overall supply of ETH. However, with the rise of layer 2 solutions and the subsequent decrease in on-chain transactions, the number of ETH burned has decreased.

As a result, Ethereum’s supply remains relatively inflationary. While this may not have an immediate detrimental impact, it is something that the Ethereum community needs to monitor closely. The balance between transactions processed on the main Ethereum network and those off-loaded to layer 2 solutions will play a crucial role in determining the overall supply dynamics of ETH.

The proliferation of layer 2 solutions is a significant development for Ethereum. It offers a practical and effective means to address the scalability issues that have plagued the network and hindered its growth. The reduction in transaction fees is a welcome relief for users who were previously burdened by high costs.

However, it is important for the Ethereum ecosystem to strike a balance between the benefits of layer 2 solutions and the supply dynamics of its native token. Finding the right equilibrium will ensure that Ethereum continues to provide a scalable and efficient platform for decentralized applications, all while maintaining the value and integrity of its digital asset, Ether.