Fisker was dealing with “potential monetary misery” as early as final August, based on a brand new submitting in its Chapter 11 chapter continuing, which the EV startup initiated earlier this week.

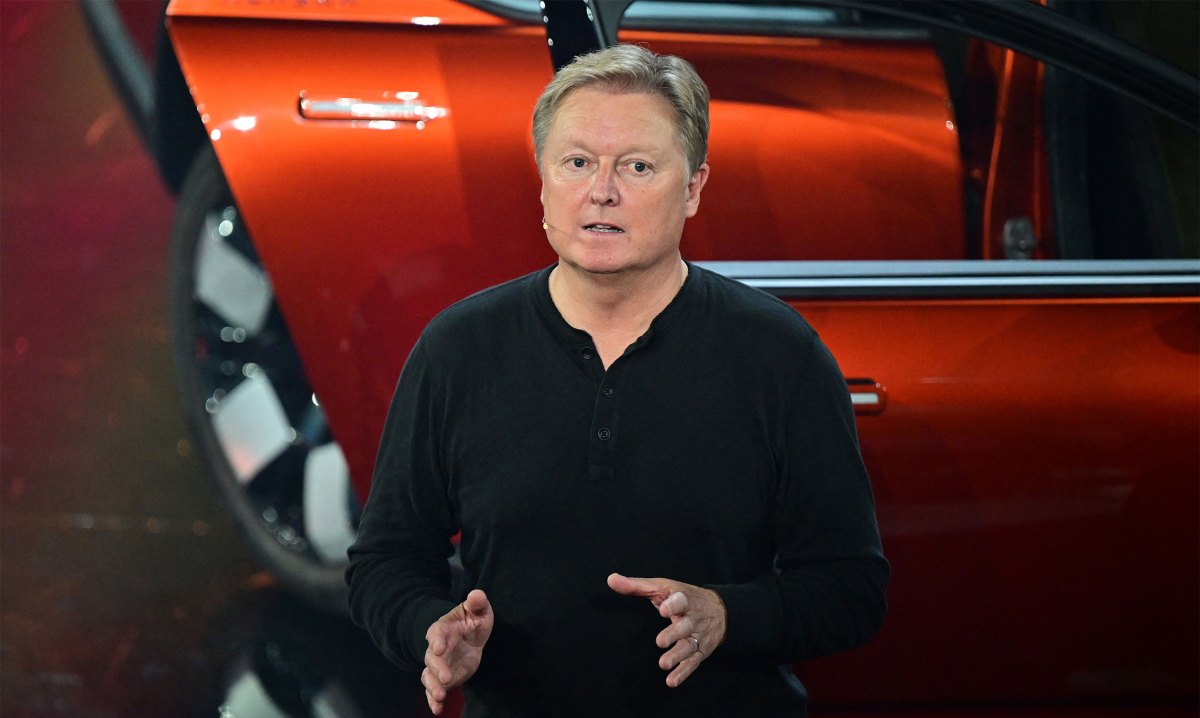

The admission gives a clearer image of Fisker’s troubles in 2023 because it struggled to ramp up deliveries of its flagship Ocean SUV, regardless of CEO Henrik Fisker’s assurances to the general public on the time. In August 2023, at the same time as Fisker’s monetary well being started to wane, the corporate held a “Product Imaginative and prescient Day” occasion to advertise a number of new fashions in improvement, together with a low-cost EV and an electrical pickup truck.

“Fisker isn’t standing nonetheless,” Henrik Fisker said at the time. “We wish the world to know that we’ve massive plans and intend to maneuver into a number of totally different segments, redefining every with our distinctive mix of design, innovation, and sustainability.”

That looming monetary misery drove Fisker to solicit a partnership or funding from one other automaker, based on the submitting, which was written by the startup’s appointed chief restructuring officer. Talks with that automaker, which Reuters first reported to be Nissan, dragged on for months earlier than falling aside earlier this 12 months, placing Fisker in “a precarious place,” based on the submitting. Fisker finally stopped manufacturing of the Ocean earlier this 12 months, went by a number of rounds of layoffs, and is now starting the chapter course of.

The Chapter 11 proceedings are supposed to supply Fisker some “respiratory room” to “stabilize operations whereas pursuing an orderly and environment friendly liquidation of belongings.” With so many collectors and money owed, it’s unclear whether or not the corporate will function in any significant manner as soon as these belongings are gone.

One of many extra quick points set to be resolved within the case is what occurs to the remaining Fisker Oceans which have gone unsold. Brian Resnick, a lawyer for Davis Polk who’s representing Fisker within the Chapter 11 case, mentioned in a listening to Friday that the corporate has reached an “settlement in precept” to promote the 4,300 unsold Oceans to an unnamed car leasing firm.

“We discover ourselves within the scenario of needing to hunt approval of this sale on quick discover,” Resnick mentioned, although he famous that the attorneys engaged on behalf of Fisker nonetheless must file an official movement to execute any such sale.

The cash generated by that or some other gross sales of Fisker’s belongings will possible go proper to Fisker’s largest (and solely) secured creditor, Heights Capital Administration, an affiliate of economic companies big Susquehanna Worldwide Group.

Heights loaned greater than $500 million to Fisker in 2023, with the choice to transform that debt to inventory within the firm. Fisker was late submitting its third quarter monetary report with the SEC, which breached a covenant of that cope with Heights. To restore that breach, Fisker granted Heights “first-priority safety curiosity on all present and future belongings.” Additional breaches within the coming months put Heights within the driver’s seat of Fisker’s monetary scenario.

And but, Fisker says within the Chapter 11 filings that it nonetheless owes Heights greater than $183 million in principal funds.

Fisker has different belongings past the Ocean SUVs that it might promote within the Chapter 11 course of, together with tools that contract producer Magna used to construct the autos. There are 180 meeting robots, a whole underbody line, a paint store and different instruments. Fisker hasn’t but provided a selected accounting of these belongings or their worth, saying solely that its complete belongings vary between $500 million and $1 billion. A few of them are “specialised,” which means it might be laborious to discover a purchaser who sees worth in them.

Fisker additionally says in one of many filings that its low-cost Pear EV was in “superior improvement,” and that the Alaska pickup truck was in “late-stage improvement.” It’s unclear in the mean time what, if any, worth these car designs carry. Previous to its chapter submitting, Fisker was sued by Bertrandt AG, the engineering agency it employed to co-develop each of these autos. That agency is now one in every of Fisker’s largest unsecured collectors within the chapter case.

Alex Lees, a lawyer representing one other group of unsecured collectors to whom Fisker owes greater than $600 million, raised issues through the listening to that it took “too lengthy” for Fisker to file for chapter. He known as Fisker’s relationship with Heights a “lopsided transaction” and a “horrible deal for [Fisker] and its collectors.” Scott Greissman, a lawyer representing the funding arm of Heights, mentioned Lees’ feedback had been “fully inappropriate, fully unsupported.

The filings thus far supply the rawest look but on the diminished state of Fisker. The corporate claims to be all the way down to 400 workers globally, with round 181 remaining within the U.S., 70 in Germany, 23 in Austria and 57 in India. That represents a 75% discount from the corporate’s peak.

Fisker additionally has round $4 million remaining in its numerous financial institution accounts, based on another submitting. It has about one other $6 million in restricted money. Fisker plans to promote practically $400,000 value of inventory it owns in European charging community Allego to assist offset the prices of constant elements of the enterprise, based on a budget filed Friday. It expects to spend round $1.7 million over the subsequent two weeks on worker payroll and advantages. It’s not presently budgeting any spending on IT/Software program, after-sales service or car buybacks.