Some say volatility, slightly than debt, is one of the simplest ways to consider threat as an investor, however Warren Buffett famously stated that ‘Volatility is way from synonymous with threat.’ Once we take into consideration how dangerous an organization is, we at all times like to take a look at its use of debt, since debt overload can result in wreck. We observe that MCC Meili Cloud Computing Business Funding Co., Ltd (SZSE:000815) does have debt on its stability sheet. However the actual query is whether or not this debt is making the corporate dangerous.

When Is Debt Harmful?

Debt is a device to assist companies develop, but when a enterprise is incapable of paying off its lenders, then it exists at their mercy. Half and parcel of capitalism is the method of ‘inventive destruction’ the place failed companies are mercilessly liquidated by their bankers. Whereas that’s not too widespread, we regularly do see indebted firms completely diluting shareholders as a result of lenders drive them to lift capital at a distressed worth. By changing dilution, although, debt could be an especially good device for companies that want capital to put money into progress at excessive charges of return. Once we look at debt ranges, we first think about each money and debt ranges, collectively.

View our latest analysis for MCC Meili Cloud Computing Industry Investment

What Is MCC Meili Cloud Computing Business Funding’s Debt?

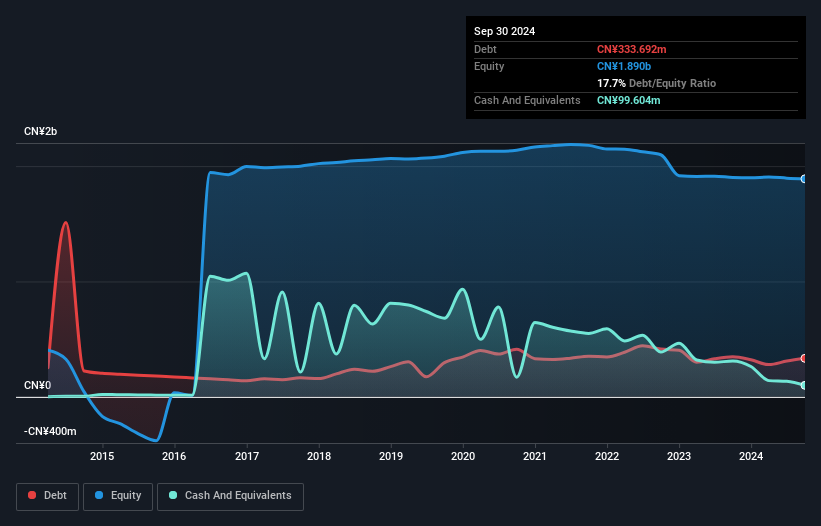

As you may see under, MCC Meili Cloud Computing Business Funding had CN¥333.7m of debt, at September 2024, which is about the identical because the yr earlier than. You possibly can click on the chart for higher element. Nevertheless, it does have CN¥99.6m in money offsetting this, resulting in internet debt of about CN¥234.1m.

How Robust Is MCC Meili Cloud Computing Business Funding’s Stability Sheet?

We will see from the latest stability sheet that MCC Meili Cloud Computing Business Funding had liabilities of CN¥622.2m falling due inside a yr, and liabilities of CN¥197.3m due past that. Offsetting this, it had CN¥99.6m in money and CN¥403.2m in receivables that had been due inside 12 months. So its liabilities whole CN¥316.7m greater than the mix of its money and short-term receivables.

Since publicly traded MCC Meili Cloud Computing Business Funding shares are price a complete of CN¥6.89b, it appears unlikely that this stage of liabilities can be a significant risk. Having stated that, it is clear that we should always proceed to watch its stability sheet, lest it change for the more severe.

We measure an organization’s debt load relative to its earnings energy by taking a look at its internet debt divided by its earnings earlier than curiosity, tax, depreciation, and amortization (EBITDA) and by calculating how simply its earnings earlier than curiosity and tax (EBIT) cowl its curiosity expense (curiosity cowl). Thus we think about debt relative to earnings each with and with out depreciation and amortization bills.

Though MCC Meili Cloud Computing Business Funding’s debt is only one.9, its curiosity cowl is de facto very low at 1.0. The principle purpose for that is that it has such excessive depreciation and amortisation. Whereas firms usually boast that these costs are non-cash, most such companies will subsequently require ongoing funding (that’s not expensed.) Both means there is not any doubt the inventory is utilizing significant leverage. Notably, MCC Meili Cloud Computing Business Funding made a loss on the EBIT stage, final yr, however improved that to constructive EBIT of CN¥11m within the final twelve months. There is no doubt that we study most about debt from the stability sheet. However you may’t view debt in whole isolation; since MCC Meili Cloud Computing Business Funding will want earnings to service that debt. So when contemplating debt, it is positively price trying on the earnings development. Click here for an interactive snapshot.

However our closing consideration can be vital, as a result of an organization can not pay debt with paper income; it wants chilly onerous money. So it is price checking how a lot of the earnings earlier than curiosity and tax (EBIT) is backed by free money circulate. Over the last yr, MCC Meili Cloud Computing Business Funding burned quite a lot of money. Whereas buyers are little question anticipating a reversal of that state of affairs sooner or later, it clearly does imply its use of debt is extra dangerous.

Our View

Each MCC Meili Cloud Computing Business Funding’s conversion of EBIT to free money circulate and its curiosity cowl had been discouraging. No less than its stage of whole liabilities provides us purpose to be optimistic. Taking the abovementioned components collectively we do suppose MCC Meili Cloud Computing Business Funding’s debt poses some dangers to the enterprise. So whereas that leverage does increase returns on fairness, we would not actually need to see it improve from right here. When analysing debt ranges, the stability sheet is the plain place to begin. Nevertheless, not all funding threat resides throughout the stability sheet – removed from it. We’ve identified 2 warning signs with MCC Meili Cloud Computing Industry Investment , and understanding them ought to be a part of your funding course of.

If, in spite of everything that, you are extra fascinated about a quick rising firm with a rock-solid stability sheet, then take a look at our list of net cash growth stocks directly.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single forex

• Be alerted to new Warning Indicators or Dangers by way of e mail or cell

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to deliver you long-term centered evaluation pushed by elementary knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.