At a first-principles stage, math varieties the inspiration of all the funds ecosystem.

There are encryption strategies that depend on superior arithmetic to safe delicate fee information; tokenization that replaces delicate information, like card numbers, with a nonsensitive equal known as a token; cryptocurrencies like bitcoin constructed fully on mathematical rules. Math isn’t simply on the coronary heart of funds — it’s the engine that drives innovation, safety and belief within the monetary ecosystem.

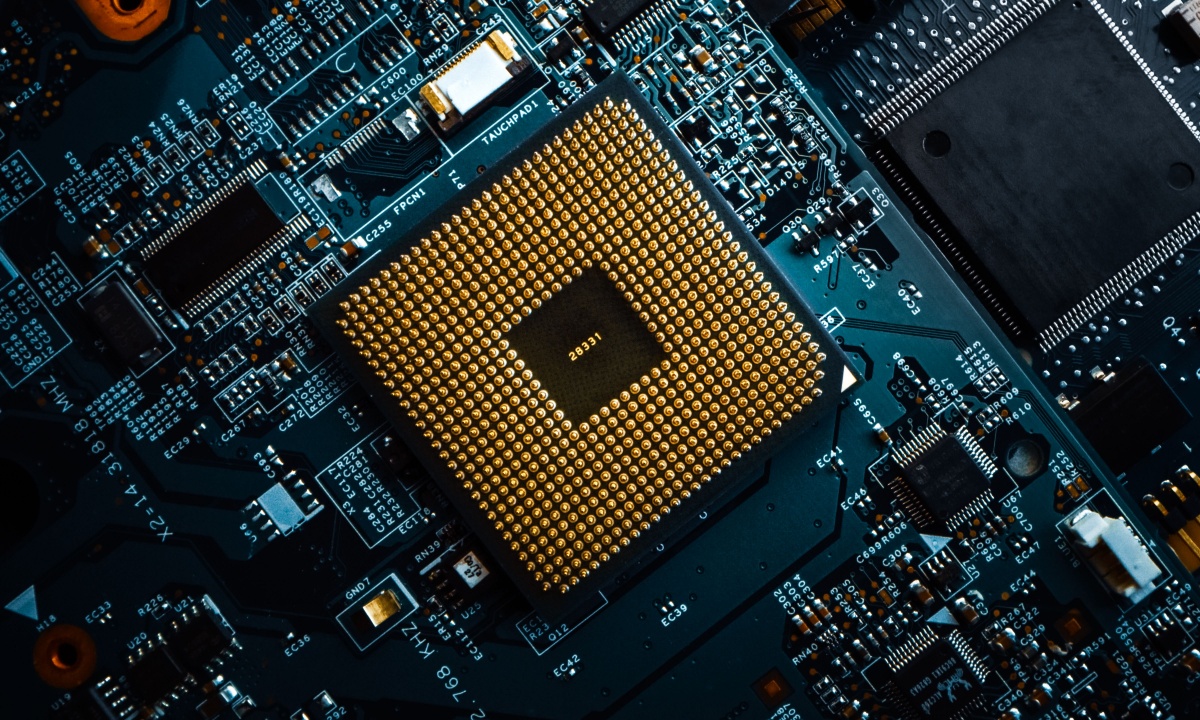

With the news that Google has created a state-of-the-art quantum chip, known as Willow, that “paves the best way to a helpful, large-scale quantum laptop,” the affect might function a wakeup name for funds and monetary companies to behave now on alternatives to enhance electronically secured methods.

Quantum computing poses a problem to many encryption algorithms in use, notably these based mostly on uneven cryptography.

In line with Hartmut Neven, founder and lead at Google Quantum AI, the Willow quantum chip carried out a computation in below 5 minutes that may take one in every of at present’s fastest supercomputers 10 septillion years, or 10 to the twenty fifth energy. “If you wish to write it out, it’s 10,000,000,000,000,000,000,000,000 years. This mind-boggling quantity exceeds recognized timescales in physics and vastly exceeds the age of the universe.”

RSA and ECC (elliptic curve cryptography), which underpin most encryption in funds, depend on the problem of fixing issues like integer factorization or the discrete logarithm drawback. A quantum laptop, like one enabled by Willow, might break these encryption schemes in seconds, rendering conventional fee encryption strategies weak to assault.

Learn extra: Making Sense of Quantum Data Defense in the Payments Space

Risk and Alternative

As PYMNTS Intelligence has discovered, a central challenge the monetary companies and banking trade now faces is the necessity each to leverage new applied sciences and to grasp the artwork of securing them.

The arrival of quantum computing presents a dual-edged situation for fee methods. Whereas quantum computer systems promise unprecedented processing capabilities that might revolutionize transaction speeds and safety, in addition they pose a menace to present cryptographic requirements.

Luckily for the fee networks, FinTechs, banks, and different key stakeholders making up the worldwide monetary system, quantum computing has a method to go earlier than being a commercially viable actuality.

The funds group can be not ready for quantum computer systems to fall into the palms of criminals to meet up with its implications. Builders and organizations are already engaged on, and have established, quantum-resistant options, together with post-quantum (PQ) cryptography.

For instance, PYMNTS covered this summer time how, after an eight-year course of, the U.S. Division of Commerce’s Nationwide Institute of Requirements and Know-how (NIST) has finalized its principal set of encryption algorithms designed to face up to cyberattacks from a quantum laptop.

In October, the Pentagon’s chief info officer additionally announced a concentrate on migrating the protection division’s methods to quantum-secure networks.

Learn extra: Quantum Breakthrough From Microsoft Could Shorten Technology’s Go-to-Market Timeline

Way forward for Safe Funds

Quantum computing presents each dangers and alternatives for cryptocurrencies like bitcoin and ethereum. Blockchain methods depend on cryptographic hash features (e.g., SHA-256 for bitcoin) and ECC for pockets keys. Whereas hash features like SHA-256 are quantum-resistant, for now, non-public keys protected by ECC could possibly be compromised by a quantum laptop.

Cryptocurrencies might, sooner or later within the subsequent 10 to twenty years, must migrate to quantum-resistant cryptographic protocols. Initiatives like Quantum Resistant Ledger (QRL) are already exploring this, however there nonetheless stays an unlimited hole between the quantum capabilities that exist at present and what can be wanted to crack the encryption of in style cryptocurrencies like bitcoin.

In an August discussion with PYMNTS, Christopher Savoie, CEO at Zapata AI, clarified that whereas quantum expertise holds large promise, the present state of quantum {hardware} will not be but at a stage the place it might probably outperform classical computer systems for many duties. “Finally, we’ll have {hardware} that does this natively,” Savoie stated, “but it surely’s going to take time till now we have fault-tolerant, completely computable methods.”

On the constructive facet of the long run, inside blockchain-based finance, quantum computing might additionally work to enhance transaction validation speeds, optimize mining algorithms, and improve good contract effectivity.