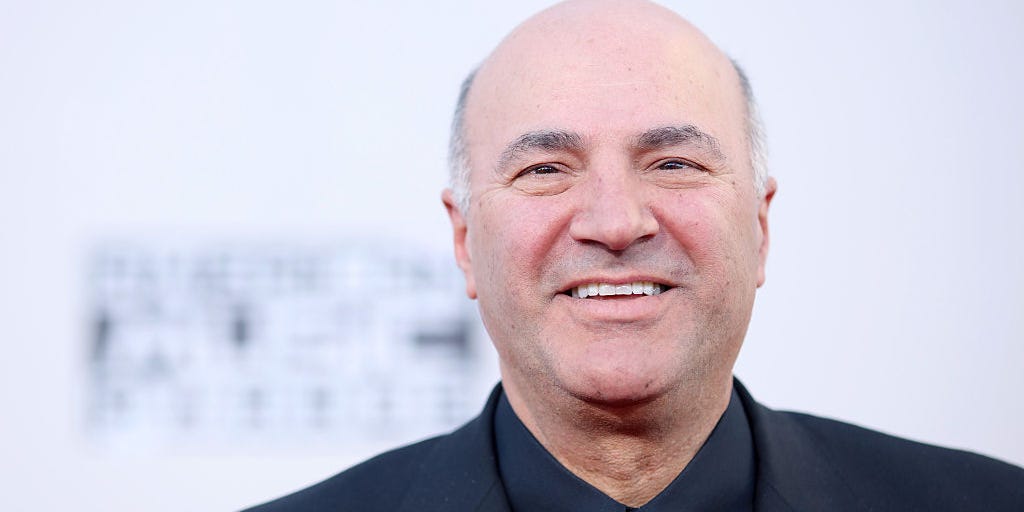

Title: Institutional Investment in Bitcoin Hindered by Lack of Compliant Exchanges, says Kevin O’Leary

Introduction:

Despite increasing discussions about the entry of top institutional players into the bitcoin market, industry expert Kevin O’Leary, known for his role on “Shark Tank,” has expressed skepticism. O’Leary believes that institutional investment in bitcoin is being hindered by the absence of compliant and transparent cryptocurrency exchanges. In his view, the ongoing scrutiny and legal actions by regulatory authorities, particularly the US Securities and Exchange Commission (SEC), create a challenging environment for institutions looking to invest in bitcoin.

The Case Against Bitcoin Spot ETFs:

Asset management giants like BlackRock and Fidelity have recently filed applications to launch the first-ever bitcoin spot exchange-traded funds (ETFs). While this move has generated optimism in the market, O’Leary contends that these ETFs are unlikely to materialize due to the regulatory landscape surrounding cryptocurrencies. He argues that the SEC’s continued scrutiny and lawsuits against industry players make it difficult for institutions to enter the bitcoin market through ETFs.

Lack of Institutional Interest:

Contrary to popular belief, O’Leary claims that institutional interest in bitcoin is currently limited. He argues that institutions are hesitant to invest in bitcoin while the SEC, led by Chairman Gary Gensler, is actively pursuing lawsuits against various industry participants. The SEC’s legal actions, primarily targeting unregulated securities, create a sense of uncertainty for potential institutional investors.

The Impact of Regulatory Crackdowns:

O’Leary highlights the SEC’s lawsuits against major cryptocurrency exchanges Coinbase and Binance as significant hurdles for institutional investors. He argues that the reputational and legal risks associated with partnering with exchanges embroiled in regulatory battles discourage institutions from entering the market. O’Leary specifically highlights the shrinking stature of Binance and the pressure faced by its co-founder, Changpeng Zhao, as deterrents for institutional involvement.

The Trial of Sam Bankman-Fried and the Demise of Crypto Cowboys:

O’Leary makes a timely reference to the ongoing trial of Sam Bankman-Fried, whose mismanagement of the FTX exchange led to its collapse. He views this trial as another example of the industry outgrowing the era of “crypto cowboys.” O’Leary suggests that increased regulation and legal actions against industry participants will accelerate the professionalization of the cryptocurrency market, leaving behind a more responsible and regulated environment.

The Importance of Compliant Exchanges:

According to O’Leary, for bitcoin to appreciate in value and attract institutional investment, it must be listed on compliant exchanges regulated and approved by relevant authorities. He points out that the lack of such exchanges in the US poses a significant obstacle to the expansion of the industry. O’Leary further suggests that if compliant exchanges emerge in other parts of the world, it may divert institutional interest away from the US market.

Conclusion:

Kevin O’Leary’s remarks shed light on the current challenges faced by institutional investors looking to enter the bitcoin market. He emphasizes the crucial role of compliant and transparent exchanges in attracting institutional investment. While regulatory scrutiny and legal actions may pose hurdles in the short term, O’Leary remains optimistic that the increasing professionalization of the cryptocurrency industry will ultimately pave the way for institutional involvement and wider market expansion.