Regardless of an already sturdy run, MCC Meili Cloud Computing Business Funding Co., Ltd (SZSE:000815) shares have been powering on, with a acquire of 27% within the final thirty days. Taking a wider view, though not as sturdy because the final month, the complete 12 months acquire of 13% can be pretty cheap.

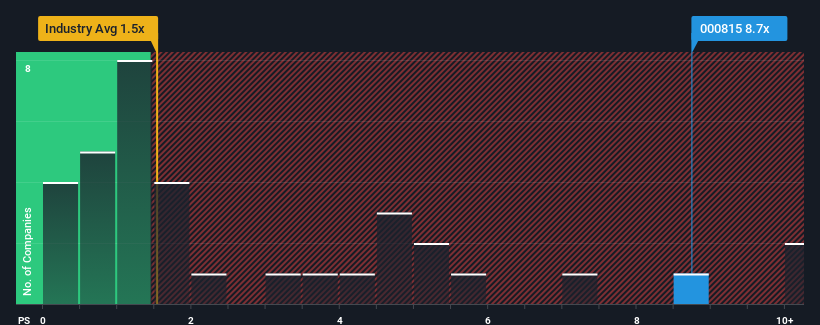

Since its worth has surged larger, when nearly half of the businesses in China’s Forestry business have price-to-sales ratios (or “P/S”) under 1.5x, chances are you’ll contemplate MCC Meili Cloud Computing Business Funding as a inventory not value researching with its 8.7x P/S ratio. Nonetheless, we would have to dig a bit of deeper to find out if there’s a rational foundation for the extremely elevated P/S.

Check out our latest analysis for MCC Meili Cloud Computing Industry Investment

For instance, contemplate that MCC Meili Cloud Computing Business Funding’s monetary efficiency has been poor these days as its income has been in decline. Maybe the market believes the corporate can do sufficient to outperform the remainder of the business within the close to future, which is holding the P/S ratio excessive. If not, then present shareholders could also be fairly nervous in regards to the viability of the share worth.

Though there aren’t any analyst estimates accessible for MCC Meili Cloud Computing Business Funding, check out this free data-rich visualisation to see how the corporate stacks up on earnings, income and money circulation.

What Are Income Development Metrics Telling Us About The Excessive P/S?

With a purpose to justify its P/S ratio, MCC Meili Cloud Computing Business Funding would want to supply excellent progress that is nicely in extra of the business.

In reviewing the final 12 months of financials, we have been disheartened to see the corporate’s revenues fell to the tune of seven.1%. The final three years do not look good both as the corporate has shrunk income by 15% in combination. Due to this fact, it is truthful to say the income progress just lately has been undesirable for the corporate.

Weighing that medium-term income trajectory towards the broader business’s one-year forecast for enlargement of 15% reveals it is an disagreeable look.

With this data, we discover it regarding that MCC Meili Cloud Computing Business Funding is buying and selling at a P/S larger than the business. It appears most buyers are ignoring the latest poor progress charge and are hoping for a turnaround within the firm’s enterprise prospects. There’s an excellent probability present shareholders are setting themselves up for future disappointment if the P/S falls to ranges extra in step with the latest unfavorable progress charges.

The Ultimate Phrase

The sturdy share worth surge has result in MCC Meili Cloud Computing Business Funding’s P/S hovering as nicely. Whereas the price-to-sales ratio should not be the defining consider whether or not you purchase a inventory or not, it is fairly a succesful barometer of income expectations.

We have established that MCC Meili Cloud Computing Business Funding presently trades on a a lot larger than anticipated P/S since its latest revenues have been in decline over the medium-term. Proper now we aren’t comfy with the excessive P/S as this income efficiency is very unlikely to help such constructive sentiment for lengthy. Except the latest medium-term situations enhance markedly, buyers can have a tough time accepting the share worth as truthful worth.

You at all times have to pay attention to dangers, for instance – MCC Meili Cloud Computing Industry Investment has 2 warning signs we predict you have to be conscious of.

If sturdy firms turning a revenue tickle your fancy, then you definately’ll wish to try this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a vast variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers through e mail or cellular

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.