It has been a superb week for Nintendo Co., Ltd. (TSE:7974) shareholders, as a result of the corporate has simply launched its newest half-year outcomes, and the shares gained 2.9% to JP¥8,193. Income of JP¥523b surpassed estimates by 7.5%, though statutory earnings per share missed badly, coming in 43% beneath expectations at JP¥23.80 per share. Earnings are an essential time for buyers, as they will monitor an organization’s efficiency, take a look at what the analysts are forecasting for subsequent 12 months, and see if there’s been a change in sentiment in direction of the corporate. We thought readers would discover it fascinating to see the analysts newest (statutory) post-earnings forecasts for subsequent 12 months.

View our latest analysis for Nintendo

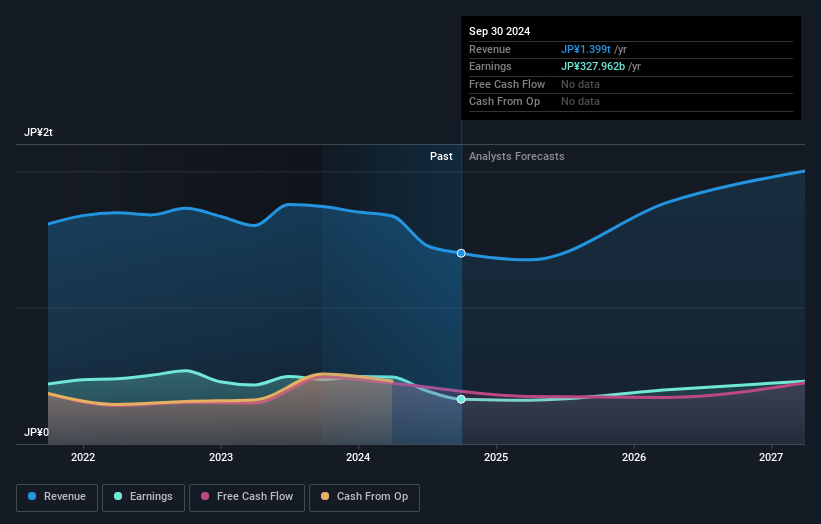

Following the current earnings report, the consensus from 23 analysts protecting Nintendo is for revenues of JP¥1.35t in 2025. This suggests a discernible 3.5% decline in income in comparison with the final 12 months. Statutory earnings per share are forecast to lower 2.7% to JP¥274 in the identical interval. Within the lead-up to this report, the analysts had been modelling revenues of JP¥1.37t and earnings per share (EPS) of JP¥283 in 2025. So it appears like there’s been a small decline in total sentiment after the current outcomes – there’s been no main change to income estimates, however the analysts did make a minor downgrade to their earnings per share forecasts.

The consensus value goal held regular at JP¥9,013, with the analysts seemingly voting that their decrease forecast earnings aren’t anticipated to result in a decrease inventory value within the foreseeable future. There’s one other method to consider value targets although, and that is to have a look at the vary of value targets put ahead by analysts, as a result of a variety of estimates might counsel a various view on doable outcomes for the enterprise. There are some variant perceptions on Nintendo, with probably the most bullish analyst valuing it at JP¥10,700 and probably the most bearish at JP¥5,800 per share. Analysts positively have various views on the enterprise, however the unfold of estimates isn’t large sufficient in our view to counsel that excessive outcomes might await Nintendo shareholders.

One other method we are able to view these estimates is within the context of the larger image, comparable to how the forecasts stack up towards previous efficiency, and whether or not forecasts are roughly bullish relative to different corporations within the industry. These estimates suggest that income is predicted to gradual, with a forecast annualised decline of 6.8% by the top of 2025. This means a big discount from annual development of two.7% during the last 5 years. Examine this with our information, which means that different corporations in the identical business are, in mixture, anticipated to see their income develop 8.5% per 12 months. So though its revenues are forecast to shrink, this cloud doesn’t include a silver lining – Nintendo is predicted to lag the broader business.

The Backside Line

A very powerful factor to remove is that the analysts downgraded their earnings per share estimates, exhibiting that there was a transparent decline in sentiment following these outcomes. Fortuitously, the analysts additionally reconfirmed their income estimates, suggesting that it is monitoring according to expectations. Though our information does counsel that Nintendo’s income is predicted to carry out worse than the broader business. The consensus value goal held regular at JP¥9,013, with the most recent estimates not sufficient to have an effect on their value targets.

Conserving that in thoughts, we nonetheless suppose that the long term trajectory of the enterprise is rather more essential for buyers to contemplate. Now we have forecasts for Nintendo going out to 2027, and you’ll see them free on our platform here.

We additionally present an outline of the Nintendo Board and CEO remuneration and size of tenure on the firm, and whether or not insiders have been shopping for the inventory, here.

Valuation is complicated, however we’re right here to simplify it.

Uncover if Nintendo may be undervalued or overvalued with our detailed evaluation, that includes truthful worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by basic information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.