Quantum computing stocks took off this year. What’s next for the trend in 2025

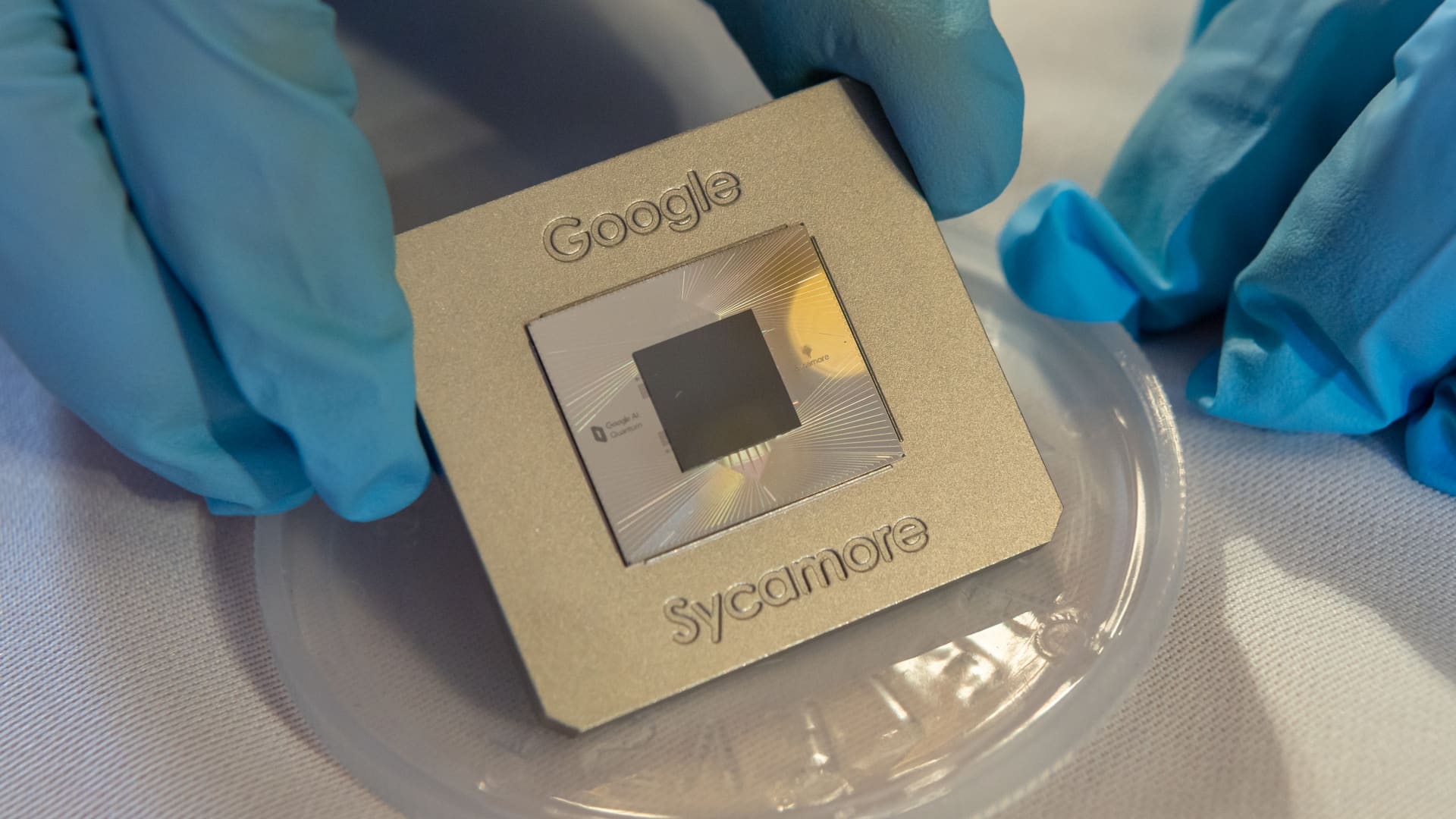

Quantum computing shares took off this 12 months as Google made strides within the area, however traders say it is nonetheless too quickly to reap the rewards of the burgeoning development. Because the launch of synthetic intelligence craze with ChatGPT’s late 2022 debut , traders have been on the hunt for the subsequent massive expertise development. Many traders assumed they discovered that contender this month, when quantum computing shares surged after Google mentioned its Willow chip carried out higher than its 2019 predecessor and “can cut back errors exponentially as we scale up utilizing extra qubits.” A qubit is a quantum bit unit to encode information. RGTI YTD mountain Share efficiency in 2024 The information pushed up shares of Rigetti Computing , IonQ , D-Wave Quantum and different linked names — and that pleasure hasn’t dwindled . Within the weeks since, these shares have continued to rally, with the Defiance Quantum ETF (QTUM) monitoring the area up 17% in December and 52% on the 12 months. Rigetti has surged 272% this month and greater than 1,000% 12 months thus far, whereas D-Wave has skyrocketed 163% month thus far and greater than 800% in 2024. Whereas many view quantum computing as the subsequent massive expertise development to disrupt Wall Avenue and the sector, it is too early to decipher the large winners within the area or see any real-world functions. “Any type of proof that impacts financials is manner, manner, manner out sooner or later,” mentioned Paul Meeks, chief funding officer at Harvest Portfolio Administration. “What are they going to make use of it for and is it actually a cash maker? That is going to drive the outcomes and valuation.” Too quickly to reap the rewards Regardless of making headway in current weeks, quantum computing is not any new phenomenon to hit Wall Avenue. In truth, Meeks notes that industries have been discussing quantum computing for no less than a decade. Many firms and AI specialists view it as a possible resolution to assist energy in depth information facilities, however say actual use circumstances for the expertise stay years — if not many years — sooner or later. Given this setup, many portfolio managers do not view 2025 because the 12 months of quantum computing, though traders may start seeing some breakthroughs in 2026 and 2027, in keeping with AXS Investments CEO Greg Bassuk. QBTS YTD mountain Shares this 12 months. Anjali Bastianpillai, senior consumer portfolio supervisor at Pictet Asset Administration, additionally famous that fund publicity to quantum computing seems very early stage, with many pure-play names residing within the personal sector. She notes that some firms have gone public as of late via SPAC mergers. Regardless of the long-term potential, many on Wall Avenue stay cautious, equating the rise in quantum computing shares to the pop in loosely linked synthetic intelligence names on the onslaught of the revolution in late 2022 and early 2023. Meeks notes that a lot of these smaller names ended up as standard quick candidates and stay vital quick bets. “This complete quantum group is within the hypothesis overexuberance stage,” mentioned Baird’s expertise desk sector strategist Ted Mortonson. “For those who wipe out what they did and the hypothesis across the shiny object. That is going to be a really massive boy, free money circulation sport. The identical factor that the Gen AI cycle was.” Follow the megacaps In opposition to this backdrop, portfolio managers say one of the best technique for getting in on the early levels of the development is thru megacap names with different enterprise ventures. “When you have got this big funding cycle on subsequent era expertise, it’s important to play firms which have huge free money circulation, or a monopoly of their core enterprise,” Mortonson defined. That features Alphabet . As the corporate works on its quantum computing initiative with Willow, it additionally affords traders sturdy digital promoting and rising synthetic intelligence companies. Shares have surged 40% this 12 months and 16% in December. GOOGL YTD mountain Shares this 12 months Amazon , Microsoft and China-based names resembling Tencent and Baidu additionally supply some publicity to quantum computing, however the proportion of income stays small, mentioned Pictet’s Bastianpillai. Many portfolio managers additionally anticipate IBM to probably triumph a long-term winner within the area, mentioned Bassuk. “That is going to be one of many occasions when they will come again with a vengeance,” he mentioned. “They have quite a lot of funding proper now in quantum computing, and so they’ve obtained a really sturdy crew internally.”