Samsung Electronics plans to ramp up its on-device AI enterprise, with the goal of exceeding international market development within the shopper electronics section this 12 months.

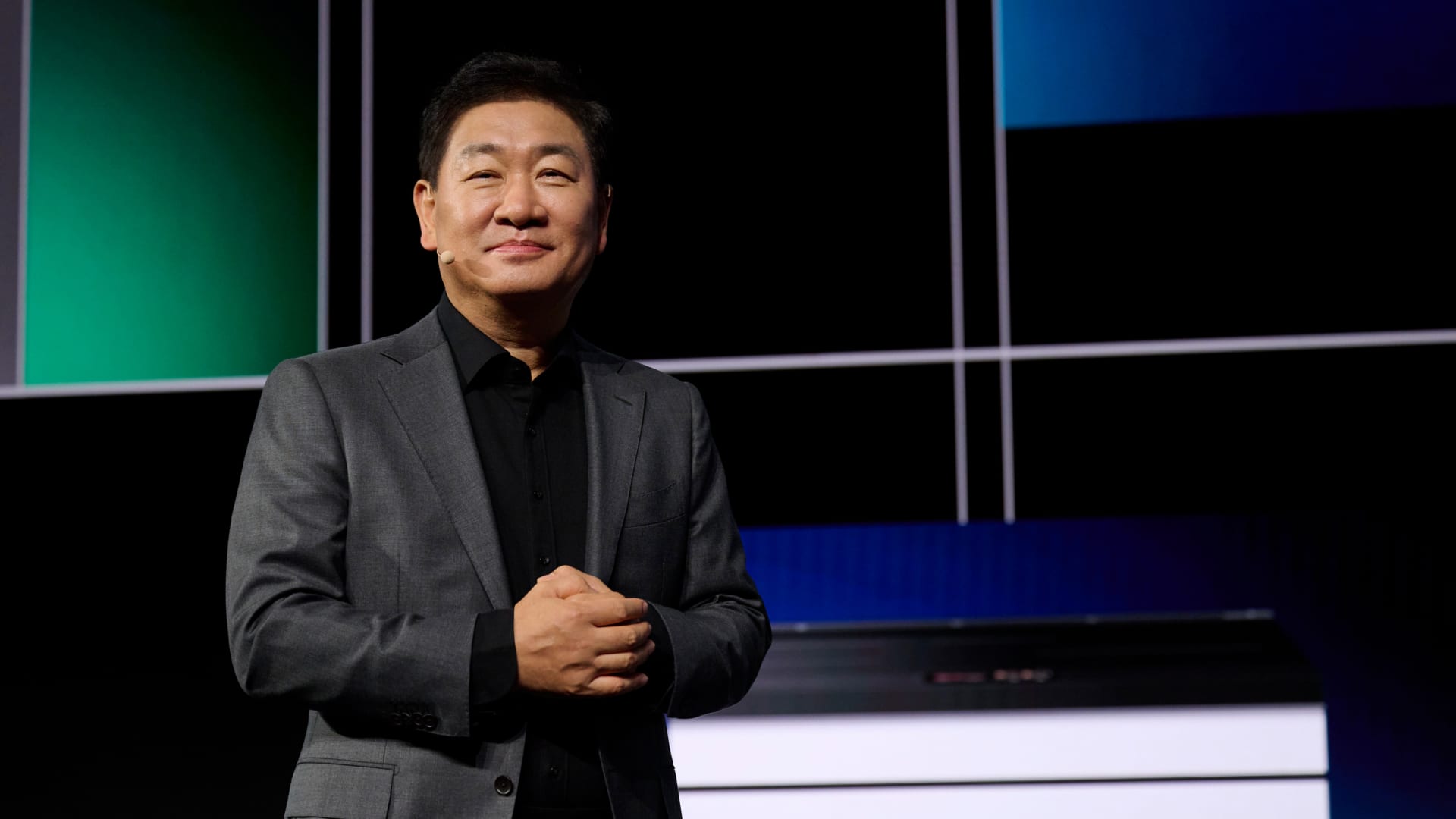

The worldwide shopper electronics marketplace for smartphone, TV and residential home equipment will develop roughly 3% in 2025, Jong-Hee Han, chief government officer of Samsung Electronics, instructed CNBC’s Chery Kang.

Samsung, the world’s largest smartphone and TV maker, expects its cell units enterprise to develop by 4%-5% this 12 months, whereas development in TV and residential home equipment unit can be prone to speed up, mentioned Han, additionally the top of gadget eExperience (DX) division of Samsung Electronics.

Samsung Electronics has been ramping up efforts to connect its devices to artificial intelligence, putting in AI chips in its fridges, washing machines and robotic vacuum cleaners.

It has additionally been bolstering its AI capabilities on its premium flagship smartphone fashions, such because the Galaxy S24 sequence, which has multiple AI-enabled features together with real-time translation of certain foreign language phone calls.

This comes as Chinese language manufacturers corresponding to Huawei and Xiaomi have emerged as serious competitors to Samsung by providing high-end smartphones at considerably decrease costs.

Competitors from Chinese language firms is ‘useful” for Samsung and the customers, Han mentioned through the interview, noting that the corporate goals to distinguish its merchandise with extra safety and comfort, moderately than decreasing costs.

AI chip delays

Samsung introduced a major leadership reshuffle in November, placing Jun Younger-hyun as co-CEO and head of the reminiscence chip arm, sharing management duties with Han.

The South Korean tech big, as soon as the dominant pressure within the reminiscence chip sector, has fallen behind SK Hynix within the race to produce excessive bandwidth reminiscence chips, or HBM chips, which might be a key element for AI chief Nvidia.

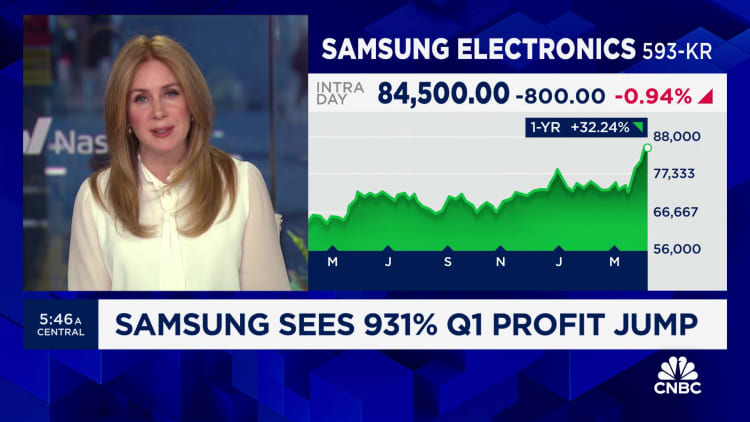

Samsung will reportedly concern its fourth-quarter revenue and working revenue forecasts on Wednesday, earlier than releasing quarterly leads to late January.

Samsung working revenue for the December quarter is expected to come in at 8.2 trillion won ($5.6 billion), in response to Reuters estimates, a notable uptick from 2.8 trillion received it reported a 12 months earlier, however down from 9.18 trillion received within the prior quarter.

In October, Jun, the semiconductor division head, issued a rare apology for the company’s disappointing third-quarter efficiency.

Final 12 months, shares of the South Korean big plunged 32%, in response to LSEG information, lagging the broader benchmark Kospi’s 9.6% loss.

The share worth has “by no means been this low earlier than,” Han mentioned through the interview, including that the corporate has “value-up” plan, geared toward growing shareholders’ returns. The plan might be introduced “one after the other when it is so as,” he mentioned, in response to a CNBC translation of his assertion in Korean.

Buyers are hoping for Samsung to shut the hole on HBM and get extra severe about its “value-up” scheme, Phillip Wool, head of analysis at Rayliant World Advisors mentioned in a observe Monday, whereas including that the 10-trillion received share buyback plan could assist stabilize the inventory’s worth.

The corporate unveiled a surprise plan in November to purchase again about 10 trillion received value of shares over the next 12 months.

Peter Lee, an analyst at Citi, cautioned in a observe on Dec. 31, {that a} longer-than-expected delay in getting Nvidia’s approval for its HBM chips and weaker PC gross sales might proceed to pose draw back dangers. He maintained a “purchase” score on the inventory whereas trimming its goal worth to 83,000 received from 87,000 received.