Valkyrie, an asset manager, has made a significant move in the cryptocurrency market by purchasing Ether (ETH) futures contracts. This decision came after the company received approval to convert its existing bitcoin futures exchange-traded fund (ETF) into a two-for-one investment vehicle. With this move, Valkyrie’s Bitcoin Strategy ETF becomes the first US ETF to offer exposure to both Ether and Bitcoin futures contracts.

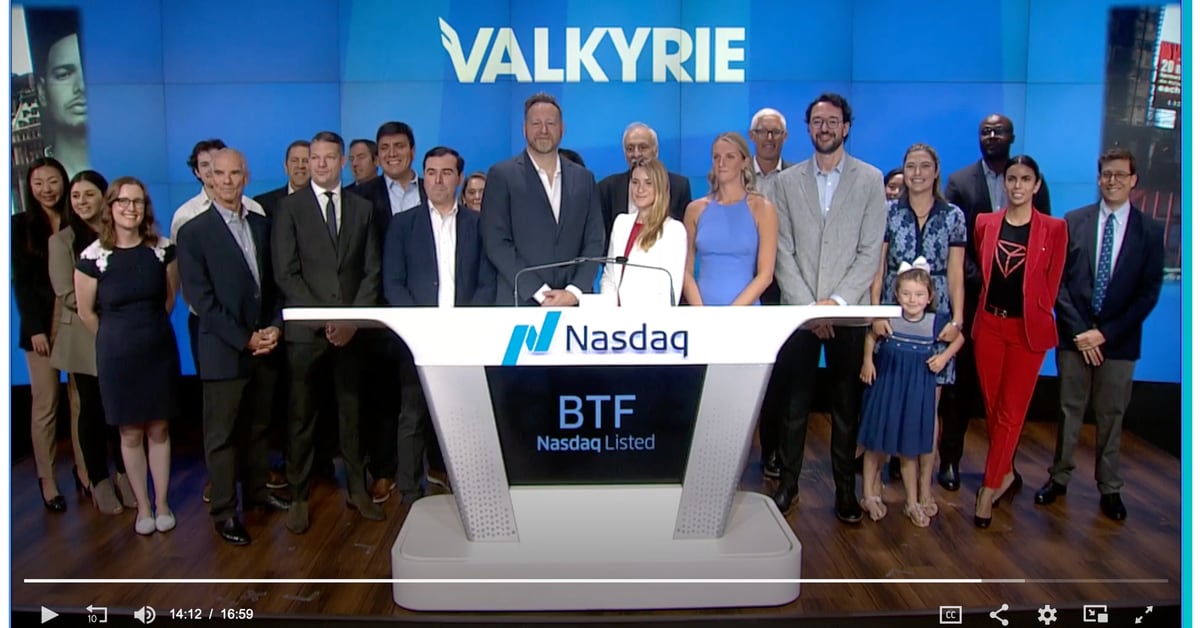

In an email statement to CoinDesk, a spokesperson from Valkyrie confirmed the company’s decision to add exposure to Ether futures contracts. They stated, “Today, the Valkyrie Bitcoin Strategy ETF (Nasdaq: $BTF) began adding exposure to Ether futures contracts, making it the first US ETF to provide exposure to Ether and Bitcoin futures contracts under one wrapper.” This move demonstrates Valkyrie’s commitment to diversifying its investment portfolio and capitalizing on the growing interest in cryptocurrencies.

Valkyrie was also the first among several other firms to receive approval for an Ethereum futures ETF. To obtain this approval, the company updated its prospectus and risk disclosures related to Ether futures. This strategic move positions Valkyrie as a leading player in the cryptocurrency ETF market, giving them a potential advantage over their competitors.

The new strategy implemented by Valkyrie involves combining both Ethereum and Bitcoin futures contracts into one ETF. This merger is set to become effective on October 3rd, and the ETF’s name will be changed to Valkyrie Bitcoin and Ether Strategy ETF. However, the ticker symbol will remain as BTF.

This development comes on the heels of another major asset management firm, VanEck, announcing its plans to launch an Ethereum futures ETF as well. With $77.8 billion in assets under management, VanEck’s entry into the Ethereum ETF market further solidifies the growing interest and acceptance of cryptocurrencies in traditional finance.

The decision by Valkyrie to include Ether in its investment strategy is a significant step towards mainstream acceptance of cryptocurrencies. By offering exposure to both Ether and Bitcoin futures contracts, the company recognizes the increasing demand from investors for diversified crypto investment options.

As more asset management firms enter the cryptocurrency market and regulatory bodies approve ETFs for cryptocurrencies, it is likely that we will see further adoption of digital assets in traditional finance. This increased acceptance could further boost the value and legitimacy of cryptocurrencies as investment assets.

Overall, Valkyrie’s move to include Ether futures contracts in its investment portfolio highlights the growing interest and acceptance of cryptocurrencies among institutional investors. By providing exposure to both Ether and Bitcoin futures contracts, Valkyrie aims to capture the potential gains from the crypto market while managing risks through diversification. This decision is a significant milestone for the cryptocurrency industry and paves the way for further adoption of digital assets in traditional finance.