In a remarkable display of financial prowess, four of the world’s leading tech companies announced their quarterly results on Thursday, showcasing a notable dichotomy in performance. Microsoft, Google, and Snap witnessed substantial growth, while IBM and Intel’s reports were met with more reserve.

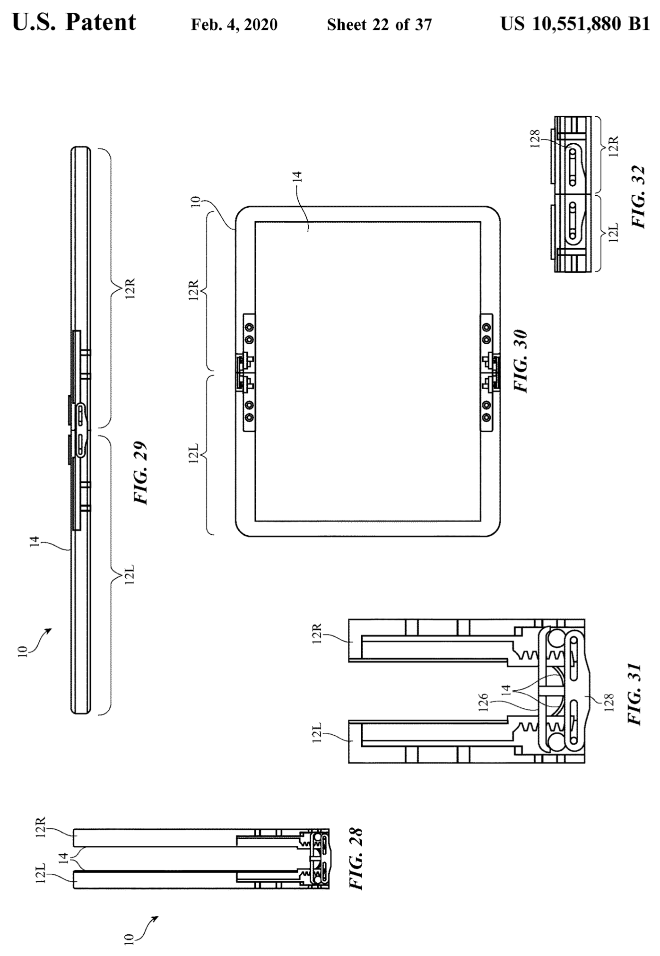

Microsoft emerged as a standout, surpassing analysts’ expectations with a reported earnings per share of $2.94 and a staggering revenue of $61.86 billion. The company’s year-over-year income soared by 20% to $21.9 billion, further solidifying its position in the tech industry. A notable 21% increase in revenue from its Intelligent Cloud business, amounting to $26.71 billion, highlighted Microsoft’s continuing domination in this sector. Despite a downturn in hardware revenues attributed to sluggish Xbox sales, Microsoft’s foray into gaming through its acquisition of Activision Blizzard paid off, with noticeable revenue growth in its gaming sector. Moreover, the company’s investment in artificial intelligence (AI) appears fruitful, with Microsoft CEO Satya Nadella mentioning that Azure has clinched more market share, with around 60% of Fortune 500 companies leveraging Copilot. This AI prowess propelled Microsoft’s market capitalization beyond $3 trillion this year, eclipsing Apple’s market value.

Google, via its parent company Alphabet, reported an impressive 11.5% growth, flirting with a $2 trillion market valuation. Alphabet announced dividends and initiated a $70 billion stock buyback plan, underscoring its financial health. The company’s earnings surged to $23.66 billion, or $1.89 per share, marking a 57% year-on-year increase. Google’s cloud computing revenues saw a 28% jump from the previous year to $9.57 billion. However, this success drew criticism from competitors like Mark Boost, CEO of CIVO, who argued that Big Tech’s dominance in the cloud market comes at the expense of competition.

Snap Inc. defied expectations, with its shares seeing a significant upward movement. The company’s quarterly revenue grew by 21% to $1.19 billion, attributed largely to enhancements in its advertising platform. The robust growth in daily active users and a 194% increase in “Other Revenue,” primarily from Snapchat+ subscribers, underscored Snap’s burgeoning appeal across all regions.

Conversely, IBM’s performance painted a mixed picture, with its quarterly results narrowly missing Wall Street’s expectations. Despite a 3% increase in revenue to $14.5 billion, it fell short of the anticipated $14.6 billion. The company’s software business segment did see a 6% increase year-on-year to $5.9 billion. However, IBM’s consulting business struggled, impacted by reductions in discretionary spending. The company’s acquisition of HashiCorp for $6.4 billion was hailed as a strategic move to bolster its hybrid cloud offerings, with its AI initiatives, including Watsonx and GenAI, surpassing $1 billion in revenue since launch.

Intel’s report revealed a 9% increase in revenue to $12.7 billion, though it failed to meet analyst predictions. The company’s outlook for the upcoming quarter also disappointed, with expected revenue lying below forecasts. Despite this, Intel reported a 31% increase in client computing revenue. Yet, its data centre and AI revenues and foundry business underperformed expectations.

Amidst this, Meta’s financial results came in stronger than anticipated with $36 billion in revenue, surpassing the consensus estimate. However, the company witnessed a sharp 17% decline in after-hours trading, attributed to investor concerns over excessive investments in the metaverse and AI despite a 39% gain earlier in 2024.

These earnings reports not only reflect the volatile nature of the tech industry but also hint at shifting priorities, with AI and cloud computing emerging as critical battlegrounds. As these companies navigate challenges and leverage opportunities, their strategies and investments will likely shape the tech landscape in the quarters to come.

Source